AGTECH: Investment Trends to Watch in a Blooming Industry

The agricultural landscape has never looked more unpredictable, and deep changes may be on the way

July 24, 2019 | By John Campbell

Farmers have adopted new technology for generations, but the speed, depth and breadth of research and products hitting the market today is truly head-spinning. Dubbed “agtech,” the application of new breeding techniques, soil microbiome enhancements, and evermore precise field and climate data applications makes feeding a growing population on improved diets quite attainable. But this unfolds against the backdrop of a society with changing values on food production.

During the past five years, the U.S. agtech sector has shown rapid expansion, both in terms of the number and diversity of companies, and it continues to provide a growing source of investment for venture capital, private equity, and strategic players. With a future poised to bring more M&A activity in the sector, as well as capital infusion to the production side, agtech is on a path of true disruption. As you read the brief analysis below, see if you do not find yourself getting excited about the disruptive possibilities too!

‘AGTECH’ DEFINED

For the purposed of this discussion, agtech will be classified into four segments:

- Plant Health and Nutrition – includes novel plant biologicals, breeding techniques, soil amendments, bio-stimulants and bio-pesticides.

- Animal Health and Nutrition – includes animal disease vaccines and medicines, new animal feeds, genetic makeup and livestock management.

- Equipment and Data – includes aerial monitoring, precision agriculture, agricultural equipment linked by the internet, big data and data analysis services.

- Food Technology – includes cultured meat, novel ingredients, plant-based proteins, food safety, new production methods and agricultural marketplace.

TOP 5 AGTECH TRENDS TO WATCH1

- The Rise of Problem Solvers: The agtech industry will continue to grow as companies try to solve problems of sustainability, pesticide and herbicide resistance, antibiotic replacements, farm level productivity, and challenging economics of traditional agricultural methods.

- An Increasingly Diverse Landscape: Since 2014, 282 agtech companies have raised $5.5 billion of private capital across 481 transactions in the U.S. and Canada. Plant Health and Nutrition has attracted the most investment, with 159 deals raising $2.2 billion, or 40 percent of all capital raised.

- Robust Capital Raising Activity: Agtech funding experienced substantial growth between 2014 – 2018, increasing from $828 million raised in 2014 to $1.4 billion in 2018, which represents a 13 percent CAGR. The average agtech capital raise has nearly doubled in size from $7.7 million in 2014 to $13.1 million in 2018, with activity growing most significantly in Food Technology and Plant Health and Nutrition.

- Smaller Deal Sizes: For the five-year period, the average M&A deal size was $11.5 million, with 61 percent of all capital raises smaller than $5 million and 27 percent larger than $10 million. Since 2014, 86 agtech companies have closed 128 transactions larger than $10 million. Plant Health and Nutrition had the most transactions (44 total) with deal sizes greater than $10 million. Excluding the three largest transactions in each segment, the average deal size is $8.4 million.

- Fragmented Investor Base: Since 2014, 219 institutional investors, including venture capital firms and family offices, have bet on agtech with transactions larger than $10 million in size. Of note, more than 65 percent of those investors have participated in only one-off transactions. The 10 most active venture capital firms have made 112 agtech investments.

AGTECH CAPITAL RAISES BY SEGMENT1

PLANT HEALTH AND NUTRITION

Plant Health and Nutrition (including Biologicals) have raised the most equity capital of all the segments, totaling $2.1 billion since 2014. The biggest year was in 2018 with $787 million raised, led by Indigo with a $250 million raise. Indigo also leads the pack for the five year period, with over $550 million raised in three funding rounds.

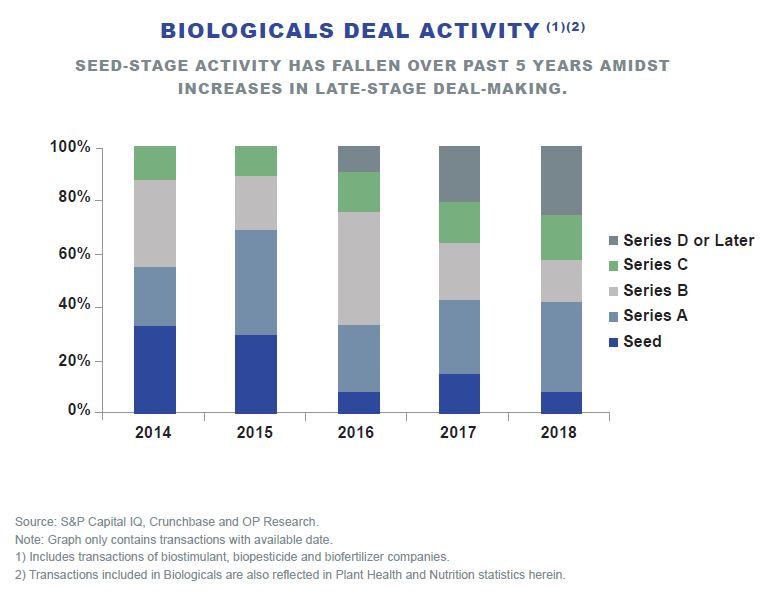

A subset of particular interest within this segment is biologicals including biopesticides, bioherbicides and soil biostimulants. In this class, we see fewer seed-stage rounds and increasing size of later-stage rounds. Fully 40 percent of the Plant Health and Nutrition investment category have been for biologicals. Significant capital raises include Indigo, Pivot Bio, Concentric Ag (formerly known as Inocucor), Marrone Bio Innovations and NewLeaf Symbiotics.

ANIMAL HEALTH AND NUTRITION

We saw little animal health and nutrition capital raising activity in 2018, but for the five-year period, companies raised $831 million through 78 deals. Ginkgo Bioworks (which is not exclusively Animal Health and Nutrition) clearly led this category, capturing nearly 60 percent of the funding. Kemin, Calysta, Recombinetics and Agrivida raised the balance of 40 percent among the top 10.

EQUIPMENT AND DATA

Since 2014, this sector has raised over $1 billion. Leading the pack is Farmers Business Network (FBN) with $150 million raised in two rounds in 2017. The 10 largest raises, totaling $423 million, represented 41 percent of the all capital raised in the five-year period. In addition to the two FBN raises, Benson Hill Biosystems, FarmLink, Farmers Edge, CiBO Technologies, Caribou Biosciences, Mavrx, and FarmLogs rounded out the remaining 59 percent of capital raised among the top 10.

FOOD TECHNOLOGY

In the Food Technology segment (excluding food delivery), over $1.6 billion of private equity capital has been raised since 2014. The 10 largest transactions accounted for nearly 58 percent of the total. In three raises, Impossible Foods accounted for nearly $400 million, or 25 percent of total funding. Plenty, Impossible Foods, JUST, Ripple, Bright Farms, Beyond Meat and Soylent rounded out the top 10 raises. In May 2019, Beyond Meat successfully raised $241 million in its initial public offering.

RECENT DEAL ACTIVITY

In year-to-date 2019, the Food Technology segment has attracted five of the 10 largest agtech capital raises, driven by rising consumer demand for plant-based foods such as meat substitutes and alternative proteins. Five Motif Ingredients, 80 Acres Farms, Clara Foods, Myco Technology and TemperPack have collectively raised $223 million, or 71 percent among the top 10 raises.

AGTECH FUNDERS

Since 2014, the 10 most active financial sponsors have made 112 of the 481 transactions, or around 23 percent of the agtech investments in the U.S. The most active investor, S2G Ventures, has made 17 investments spanning all four agtech segments. Khosla Ventures is close behind with 16 investments in all segments except Animal Health and Nutrition.

Among funders, Y Combinator, Google Ventures, MGV, Middleland Capital, Cultivian Sandbox, Kliener Perkins, The Yield Lab, and Anterra Capital round out the top 10, each with multiple capital inserts across the spectrum of agtech. Many funders appear to be making intra-sector investments with multiple bets in the same space. These statistics indicate that financial sponsorship is widely diverse and not highly concentrated among few funders.

MERGERS AND ACQUISITIONS

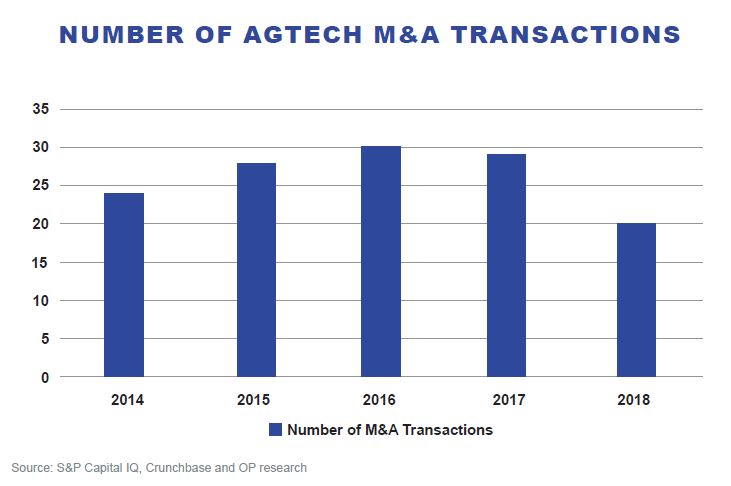

Since 2014, there have been 131 transactions totaling $6.3 billion of M&A activity. This analysis does not include the mega-mergers. Ten buyers accounted for 22 percent of transaction volume since 2014.

Only 20 transactions were recorded in 2018, making it the quietest year out of the last five. The megamergers of Dow/DuPont with BASF, Bayer’s acquisition of Monsanto, ChemChina’s acquisition of Syngenta, the Agrium/PotashCorp merger that formed Nutrient, and Eastman Chemical’s acquisitions of Taminco drew attention away from smaller deals.

Ocean Park believes that M&A activity will accelerate as these new mega companies complete their reorganizations and go back on the hunt for accretive acquisitions. The most active acquirers with multiple transactions in the period include Pinnacle Agriculture, The Climate Corporation, Scotts Miracle-Gro, Intrexon, Nutrien, Bayer, DTN, DuPont, John Deere and Verdesian. These companies accounted for about 22 percent of M&A volume since 2014.

CASE STUDY: GINKGO BIOWORKS

A fascinating success story, the Bill Gates-backed company Ginkgo Bioworks is not to be classified into one category. Once a billion-dollar startup, the company designs custom microbes for customers across multiple markets for a variety of end uses. The 9-year-old company may be the first billion-dollar unicorn in the agtech sector. Formed by a stellar team of MIT PhD students and old pros, including Tom Knight, former MIT professor and grandfather of synthetic biology; George Church, a Harvard geneticist; and Craig Venter, whose company, Synthetic Genomics, first mapped the Human Genome. Launched from the Y Combinator American seed incubator, Ginkgo has gone on to form functional groups.

On the Ag front, Ginkgo formed a $100 million joint venture with Bayer called Joyn Bio to focus on microbial fixation of nitrogen, thus leading to less synthetic fertilizer use. In the food sector, Ginkgo recently spun out Motif Ingredients in a $90 million Series A round, led by Gates and fellow billionaires, aimed at plant-based proteins.

Similarly, Precision BioSciences and Recombinetics are not included in this analysis as their technology has wide-ranging applications toward agriculture as well as human and industrial efforts.

KEY TAKEAWAYS AND FORECASTING

The agtech industry continues to garner significant investment and interest from institutional and strategic investors. We believe future trends are likely to include the following:

- Agtech is a growing industry, which is likely to continue, both from the number of companies entering the space and from the amount of investments deploying in the industry.

- Some subsectors are more highly invested than others, with Plant Health and Nutrition and Food Technology garnering the lion’s share of capital invested.

- Significant opportunity exists within underinvested sectors, such as animal health and food traceability, with promising, scalable technologies.

- Larger deal sizes will rule the day. Transaction sizes are getting larger as companies in the industry begin to mature, and their financial capital needs increase in order to enter broader market commercialization.

- As investment rounds grow, the target investor universe will expand to attract more sophisticated institutional investors, but whose demands for investment will require more polished marketing materials (i.e., teaser, management presentation, and financial model), and clear pathways to commercialization and profitability.

When we study agtech, we are really looking at food and the food production system. Is the recent Beyond Meat IPO a (vegetarian) flash in the pan, or are we seeing a fundamental shift in dietary patterns? Regardless, phrases like “sustainability” and “climate change” are on the lips of every major food retailer. We have yet to see how this filters down through the supply chain and what it means to farmers, ranchers and the industries that serve them.

One thing is for sure – past technology has primarily pursued ever-higher crop yields and predictably lower prices, but we stand on the verge of that model’s disruption. Today, a significant number of consumers show more concern about how their food is produced and its impact on the environment, human health, and animal welfare, rather than how much it costs. That trend shows no sign of slowing down.

For those companies able to crack the newly emerging social contract between food production and consumption, the future looks very bright indeed.

1 AgTech data is sourced from S&P Capital IQ, Crunchbase, Finistere Ventures, and Ocean Park research.

ABOUT THE AUTHOR

JOHN CAMPBELL serves as Managing Director of Ocean Park with three decades of experience in the food and agribusiness sector. He has extensive operating experience among many aspects of the ag and food supply chain, including livestock and crop production, grains, feed, soybean processing, vegetable oil refining, ethanol and biodiesel. Campbell spent over 20 years managing the Industrial Products division of Ag Processing (AGP), a multibillion-dollar value-added soybean cooperative and biodiesel producer. He also served as Deputy Undersecretary of Agriculture during the George H.W. Bush Administration. He received his BA in Animal Science from the University of Nebraska and his post graduate Diploma from the University of Sydney, Australia in Agricultural Economics.

To view the original article that appeared in GAI AgTech Intel News in June 2019: Click Here

To download a PDF copy of the article: Click Here

Ocean Park is a leading boutique investment bank focused on the renewable fuels, energy, food and agribusiness sectors. The Ocean Park team has significant operational and transaction experience, including advising on mergers and acquisitions, financings and restructurings. Since its founding in 2004, Ocean Park has successfully completed over 60 transactions and client engagements. Its professionals are based in Los Angeles, Houston, Omaha and New York.

Any securities are offered through Ocean Park Securities, LLC, a member of FINRA and SIPC. Ocean Park’s professionals are licensed registered representatives of Ocean Park Securities, LLC. For more information, please visit oceanpk.com or call (310) 670-2093.