AGTECH 2019: Year in Review and Five-Year Investment Trends

April 8, 2020 | By John Campbell and Eric Ouyang

Overall AgTech investment in the United States slowed slightly in 2019 but remained strong and near five-year peaks.

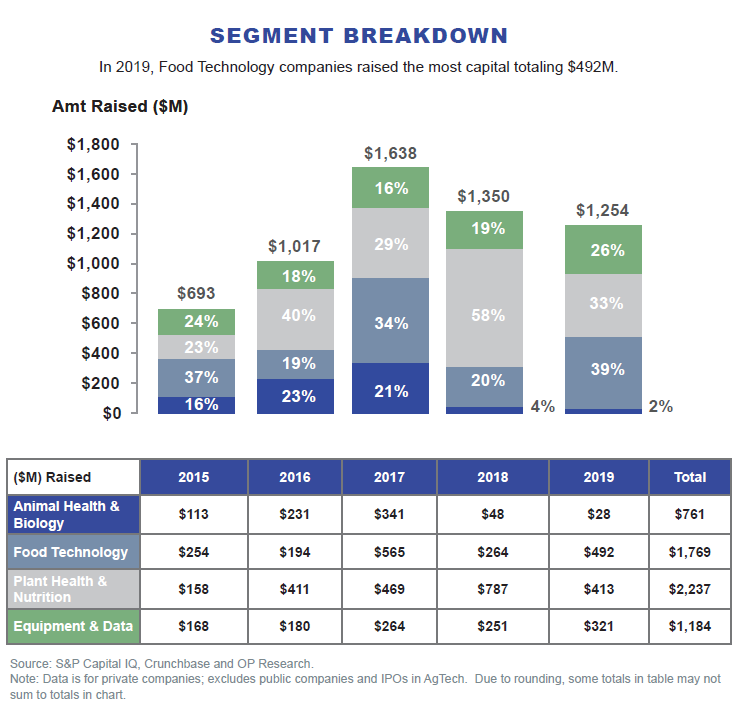

Boom in Food Technology. The Food Technology segment flourished as the segment saw the most rapid growth from the prior year resulting from increased investor interest in plant-based meat substitute companies.

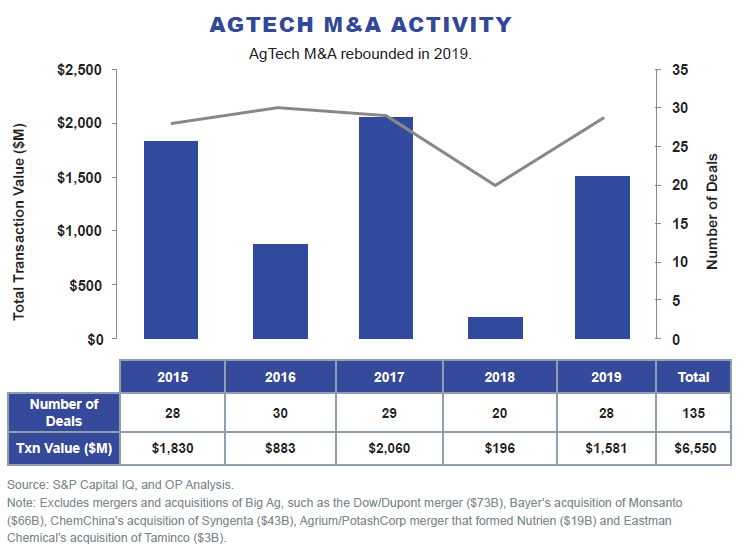

Rebound in Mergers & Acquisitions. Another optimistic note from 2019 was the significant rebound in M&A transactions from a five-year low in 2018. A plethora of new buyers entered the M&A market as all completed transactions during the year featured acquirors who did not make a purchase in the past five years.

Farmers Face Uncertainty. Farmers and ranchers continued to face income headwinds due in part to adverse weather, ongoing trade conflicts and now the coronavirus. Although the Trump Administration has provided significant income assistance to farmers, future economic uncertainty has translated into reduced capital improvements at the farm and limited adoption of new agricultural equipment and technology.

Fight Against Climate Change. Climate change has been partly attributed to a multitude of agricultural processes. Today, we see a shift in investment and operational strategies that view agriculture not as a problem, but as a solution to climate change. A new focus on “regenerative,” carbon negative agricultural practices and technology has begun. There is growing awareness that row crop, rangeland and forestry lands in the United States have enormous potential for carbon capture and sequestration. Importantly, these technologies and practices offer solutions on a scale necessary – and unavailable elsewhere – to address the immediate need to reduce greenhouse gas loading in the atmosphere. Green technologies supporting this effort are embedded across our AgTech database.

‘AGTECH’ DEFINED

For the purposed of this discussion, agtech will be classified into four segments:

- Plant Health and Nutrition – includes novel plant biostimulants, breeding techniques and soil amendments.

- Animal Health and Biology – includes animal disease vaccines and medicines, new animal feeds, genetic makeup, livestock management and biology companies working across silos.

- Equipment and Data – includes aerial monitoring, precision agriculture and agricultural equipment linked by the internet, big data and data analysis services.

- Food Technology – includes cultured meat, novel ingredients, plant-based proteins, food safety, new production methods and agricultural marketplace.1

One note to keep in mind as we categorize AgTech companies is that many large companies operate within multiple segments. Limited public information is available to understand the true uses of company resources across segments.

TOP AGTECH TRENDS TO WATCH2

- Increased M&A Activity. The biggest takeaway from 2019 was the rebound in M&A over the prior year resulting from the return of financial buyers. In 2019, there were 28 transactions totaling over $1.6 billion in value, a significant increase over the 20 transactions across $0.2 billion in 2018.

- The Rise of Problem Solvers. One criticism we hear is that too many companies offer solutions in search of a problem. Producers report being overwhelmed by vendors offering the latest technologies without really understanding the situation on the ground. At the macro level, the AgTech industry understands that the problems of sustainability, pesticide and herbicide resistance, antibiotic replacement and farm level productivity need solutions but early adopters are often weary of trying new products.

- An Increasingly Diverse Landscape. Since 2015, 278 AgTech companies have raised $6.0 billion of private capital across 467 transactions in the U.S. Plant Health and Nutrition has attracted the most investment, with 146 deals raising $2.2 billion, or 38 percent of all capital raised.

- Robust Capital Raising Activity. AgTech funding experienced substantial growth over the last five years, increasing from $692 million raised in 2015 to $1.3 billion in 2019, which represents a 13 percent compound annual growth. Much of the funding is aimed at disruptive technologies in the production, supply chain and consumption of food.

- Larger Deal Sizes. The average AgTech capital raise has over doubled in size from $6.5 million in 2015 to $13.3 million in 2019, with Food Technology companies averaging the highest deal size at $18.4 million during the 5-year period. Since 2015, there have been 138 transactions larger than $10 million raised by 86 AgTech companies. Plant Health and Nutrition had the most transactions (44 total) with deal sizes greater than $10 million. The average deal size is skewed by a few large transactions; excluding the top three transactions in each segment, the average deal size is $11.3 million since 2015.

- Diverse Investor Base. Since 2013, 248 institutional investors, including venture capital firms and family offices, have bet on AgTech with capital raise transactions larger than $10 million in size. Of note, more than 67 percent of those investors have participated in only a single transaction in AgTech to-date. The ten most active venture capital firms have made 133 AgTech investments since 2013.

AGTECH CAPITAL RAISES BY SEGMENT

PLANT HEALTH AND NUTRITION

Plant Health and Nutrition (including biologicals) have raised the most equity capital of all the segments, totaling $2.2 billion since 2015. The segment’s biggest capital raising year was in 2018 with $787 million raised, led by Indigo with a $250 million raise. Indigo also leads the pack for the five-year period, with over $650 million raised in three funding rounds.3

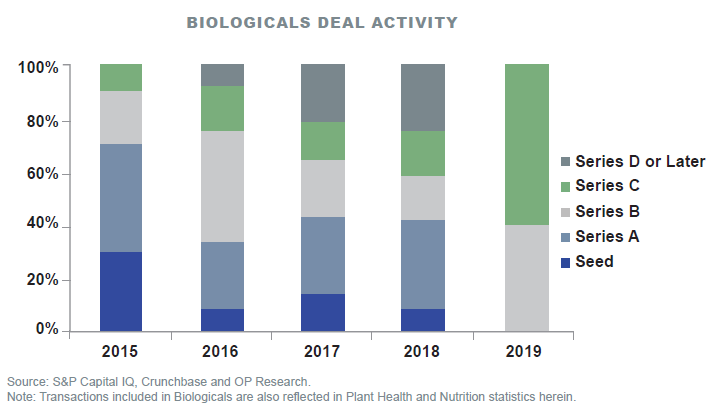

BIOLOGICALS

A subset of particular interest within Plant Health and Nutrition is Biologicals, including biopesticides, bioherbicides and soil biostimulants. The desire for sustainability and healthy living is driving the search for alternatives to synthetic chemistries. Fully 40 percent of the Plant Health and Nutrition investment category has been in Biologicals. Significant capital raises include Indigo, Pivot Bio, Concentric Ag (formerly known as Inocucor), Marrone Bio Innovations, and NewLeaf Symbiotics.

Within Biologicals, we see fewer seed-stage rounds and increasing size of later-stage rounds through 2019. Seed-stage activity has fallen over the past five years amidst increases in late-stage dealmaking.

ANIMAL HEALTH AND NUTRITION

Animal Health and Biology remains nascent and under-invested as the segment raised only $761 million, or 13 percent of all AgTech, in the trailing five years. Ginkgo Bioworks (a designer of custom microbes, which is not exclusively Animal Health and Biology) led this category, capturing nearly 49 percent of segment funding. Kemin, Calysta, Recombinetics, and Agrivida were also among the top 10 largest capital raisers since 2015.

Precision BioSciences and Recombinetics are not included in this analysis as their technology has wide-ranging applications toward agriculture as well as human and industrial efforts.

EQUIPMENT AND DATA

Since 2015, this sector has raised nearly $1.2 billion. Leading the pack is Farmers Business Network (FBN) with $150 million raised in two rounds in 2017. The 10 largest raises, totaling $473 million, represented 40 percent of the all capital raised in the five-year period. In addition to the two FBN raises, Benson Hill Biosystems, Bowery, FarmLink, Farmers Edge, Fifth Season Connection, CiBO Technologies and Caribou Biosciences rounded out the remaining 60 percent of capital raised in the segment since 2015.

FOOD TECHNOLOGY

In the Food Technology segment (excluding food delivery), over $1.8 billion of private equity capital has been raised since 2015. The 10 largest transactions accounted for 60 percent of the total. In three raises, Impossible Foods accounted for nearly $300 million, or 17 percent of total funding. Plenty, Perfect Day, Impossible Foods, Synthetic Genomics, JUST, Ripple, Bright Farms and Puris rounded out the top 10 raises. In May 2019, Beyond Meat successfully raised $241 million in its initial public offering.

Since 2015, the Food Technology segment has attracted five of the 10 largest AgTech capital raises, driven by rising consumer demand for plant-based foods such as meat substitutes and alternative proteins. Motif Ingredients, 80 Acres Farms, Clara Foods, Myco Technology and TemperPack have collectively raised $562 million, or 31 percent among the top 10 AgTech capital raises.

AGTECH FUNDERS

Since 2013, the 10 most active financial sponsors have made 133 of the 644 transactions, or around 20 percent of the AgTech investments in the U.S. The most active investor, S2G Ventures, has made 22 investments spanning all four AgTech segments. Khosla Ventures is close behind with 17 investments in all segments except Animal Health and Biology.

Among funders, Y Combinator, Middleland Capital, Cultivian Sandbox, Google Ventures, SOSV, MGV, Pangaea Ventures, and The Yield Lab round out the top 10, each with multiple capital inserts across the spectrum of AgTech. Many investors appear to be making intra-sector investments with multiple bets in the same space. These statistics indicate that financial sponsorship is widely diverse and not highly concentrated among a few funders.

MERGERS AND ACQUISITIONS

In 2019, 28 transactions encompassing nearly $1.6 billion took place, a rebound from the 20 transactions totaling $0.2 billion in 2018. Except for Nutrien’s acquisition of Actagro for $340 million, all acquisitions in 2019 were made by first-time buyers or buyers without acquisitions in the trailing five years. Financial players returned in 2019 and comprised approximately 15 percent of the total investor pool, up from 5 percent in 2018.

Since 2015, there have been 135 transactions totaling $6.6 billion of M&A activity.4 The top 10 most active acquirers during this period include Nutrien, Scotts Miracle-Gro, Bayer, Intrexon, The Climate Corporation, YARA, EFC Systems, John Deere, DuPont, and One Rock Capital Partners. These companies accounted for about 18 percent of M&A volume since 2015.

We believe that AgTech M&A activity will continue to accelerate as early-stage companies continue to mature. Large AgTech companies are expected to inorganically expand their service and product offerings given the plethora of unique, early-stage startups sprouting throughout the sector. Furthermore, mature companies undergoing operational reorganizations are expected to return to the hunt for accretive acquisitions.

KEY TAKEAWAYS AND FORECASTING

The AgTech industry continues to garner significant investment and interest from institutional and strategic investors. We believe future trends are likely to include the following:

- The future looks bright for companies that can solve the emerging social contract between food production and consumption. Technologies that have a clear impact on sustainability and climate change can expect to receive the most funding.

- AgTech is a growing industry, which is likely to continue, both from the number of companies entering the space and from the amount of investments deploying in the industry.

- Some segments are more highly invested than others, with Plant Health and Nutrition and Food Technology garnering the lion’s share of capital invested.

- Larger deal sizes will rule the day. Transaction sizes are getting larger as companies in the industry begin to mature, and their financial capital needs increase in order to enter broader market commercialization.

When we study agtech, we are really looking at food and the food production system. Is the recent Beyond Meat IPO a (vegetarian) flash in the pan, or are we seeing a fundamental shift in dietary patterns? Data suggests that US meat consumption is on the rise as consumer economic conditions improved in 2019. Regardless, phrases like “sustainability” and “climate change” are on the lips of every major food retailer, agribusiness, farm organization, family office, private equity and venture capital player. We have yet to see how this filters down through the supply chain and what it means to farmers, ranchers, and the industries that serve them.

1 Ocean Park’s definition of Food Technology does not include food delivery companies

2 Source: S&P Capital IQ, Crunchbase and OP research

3 Includes Indigo’s $200 million capital raise in January 2020.

4 Excludes mega-merger transactions (i.e., Agrium/Potash merger for $18.7 billion in 2016 and Bayer/Monsanto acquisition for $66 billion in 2016).

ABOUT THE AUTHORS

JOHN CAMPBELL serves as Managing Director of Ocean Park with three decades of experience in the food and agribusiness sector. He has extensive operating experience among many aspects of the ag and food supply chain, including livestock and crop production, grains, feed, soybean processing, vegetable oil refining, ethanol and biodiesel. Campbell spent over 20 years managing the Industrial Products division of Ag Processing (AGP), a multibillion-dollar value-added soybean cooperative and biodiesel producer. He also served as Deputy Undersecretary of Agriculture during the George H.W. Bush Administration. He received his BA in Animal Science from the University of Nebraska and his post graduate Diploma from the University of Sydney, Australia in Agricultural Economics.

ERIC OUYANG serves as Managing Director of Ocean Park with nearly two decades of investment banking experience. He has successfully completed over $50 billion of strategic advisory and capital raising transactions across a wide range of industries, including AgTech, agribusiness, biofuels, consumer products, food and renewable energy. Ouyang previously worked at Goldman Sachs in Los Angeles and New York, where he focused on financial sponsors, leveraged finance, financial institutions and financial technology. He received his BA from the Woodrow Wilson School of Public and International Affairs at Princeton University.

Ocean Park is a leading boutique investment bank focused on the renewable fuels, energy, food, AgTech and agribusiness sectors. The Ocean Park team has significant operational and transaction experience, including advising on mergers and acquisitions, financings and restructurings. Since its founding in 2004, Ocean Park has successfully completed over 60 transactions and client engagements. Its professionals are based in Los Angeles, Houston and Omaha.

| JOHN CAMPBELL Managing Director (310) 670-2093 jcampbell@oceanpk.com |

ERIC OUYANG Managing Director (310) 670-7910 eouyang@oceanpk.com |

This material is solely for informational purposes. The information in this document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security or to provide any investment advice.

Any securities are offered through Ocean Park Securities, LLC, a member of FINRA and SIPC. Ocean Park’s professionals are licensed registered representatives of Ocean Park Securities, LLC. For more information, please visit oceanpk.com or call (310) 670-2093.