A Muted Year for Biofuels M&A Activity: 2020 Review and Outlook

COVID-19 further plagues the already challenged North American biofuels M&A market, while capital investments thrive.

January 25, 2021 | By Bruce Comer and Frank Kim

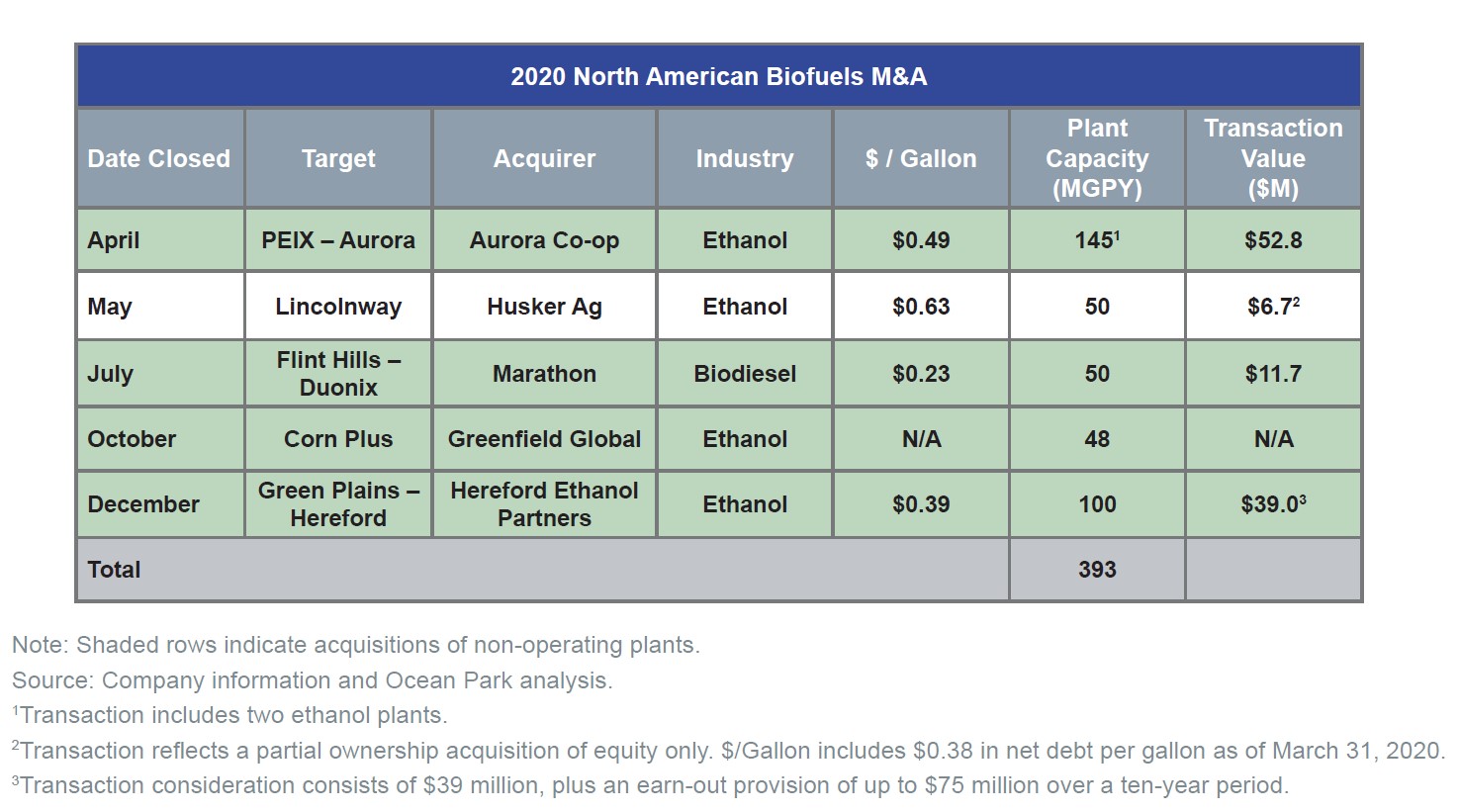

Biofuels merger and acquisition (M&A) activity in North America remained sluggish in 2020. For the second consecutive year, no large-scale, operating biofuels plant changed hands. Only five M&A transactions took place, with a total estimated value of just $110 million. These transactions involved six plants whose production capacity totalled 393 MGPY, with two of these transactions involving partial ownership stakes. Five of the six acquired plants were non-operating, representing the majority of acquired capacity. Most of the deals that closed were driven largely by distressed sellers or sellers shifting their business models. Ocean Park tracked several sales processes that were not consummated, including ADM’s sale of its three dry mills. It was also a quiet year in advanced biofuels, with only two plants changing hands.

Entering 2020, US ethanol producers faced an oversupplied ethanol market translating into a low margin environment. This pandemic-driven lockdown exacerbated the situation by significantly reducing fuel demand. The impact of these restrictions proved profound in the ethanol sector, with annual US ethanol consumption declining by 13 percent in 2020.1 Sharp reduction in demand forced many plants to idle. This high stress environment could have presented an opportunity for acquisitions, but demand for hand sanitizer greatly benefitted certain ethanol plants producing industrial alcohol and inspired others to shift towards the same. Furthermore, as a result of many plants throttling production industry-wide, the market witnessed a significant reduction in ethanol inventory and a temporary return of positive margins for stronger producers who could weather the storm. In addition, the Paycheck Protection Program (PPP) extended the cash runway for many plants. Ocean Park tracked at least 86 ethanol companies that received PPP loans.2

Another explanation for the lull in deal activity is that several existing players focused on deploying capital to investments in new technology and plant expansions. Capital investment in biofuels during 2020 dwarfed the value of deal activity. In ethanol, Green Plains completed the $38 million installation of Fluid Quip’s high-protein feed production facility at its Shenandoah, Iowa plant and began construction of a second installation at its Wood River, Illinois plant. Flint Hills also completed an installation of Fluid Quip’s high-protein technology and announced moving forward on a second installation. Several ethanol plants announced conversion of their production to industrial alcohol from fuel grade ethanol, spending substantial sums in order to produce larger volumes. In renewable diesel (RD), seven major companies announced or began construction of over 2 BGPY of new capacity that will require several billion dollars. Refer to the box below on major RD announcements.

With many companies deploying capital to RD projects, less impetus for biodiesel M&A existed. In biodiesel, Marathon Petroleum’s acquisition of a non-operating plant was the only transaction in 2020. Marathon is retrofitting the plant to a feedstock pre-treatment facility that will support its RD plant in North Dakota.

1 Based on data from the US Energy Information Administration on January 1, 2021.

2 Based on data published by the Small Business Administration on December 1, 2020.

2020 MAJOR RD ANNOUNCEMENTS

- REG announced its intent to invest $825M to expand its Geismar, LA biorefinery by 250 MGPY.

- Bakersfield Renewable Fuels received a $365M investment through a strategic partnership with Orion Energy Partners, GCM Grosvenor and Voya Investment Management to reconfigure its refinery in Bakersfield, CA to produce up to 220 MGPY of RD.

- Marathon Petroleum plans to convert its refinery in Martinez, CA to a RD facility that will produce up to 736 MGPY. The estimated cost of the project was undisclosed.

- Phillips 66 plans to convert its refinery in San Francisco, CA to a renewable fuels facility that will produce up to 680 MGPY of RD, renewable gasoline and sustainable jet fuel. The proposed facility would cost up to $800M.

- HollyFrontier announced that it will invest more than $125M to convert its refinery in Cheyenne, WY to produce up to 90 MGPY of RD. Including its previously announced RD unit at its refinery in Artesia, NM, HollyFrontier will have a combined RD capacity of 210 MGPY.

- CVR Energy plans to invest $110M to build a RD unit at its refinery in Wynnewood, OK that will produce up to 100 MGPY.

- Greentech Materials plans to build a RD plant at the Port of Baton Rouge, LA that would produce up to 336 MGPY. The estimated cost of the project was undisclosed.

Other announcements:

- Diamond Green received an air permit for a potential 400 MGPY RD plant in Port Arthur, TX. An investment decision is expected in early 2021.

- Marathon completed its conversion of its Dickinson, ND refinery into a renewable fuels facility. At full capacity, the facility is expected to produce 184 MGPY of RD from corn and soybean oil.

Source: Company news and Ocean Park research.

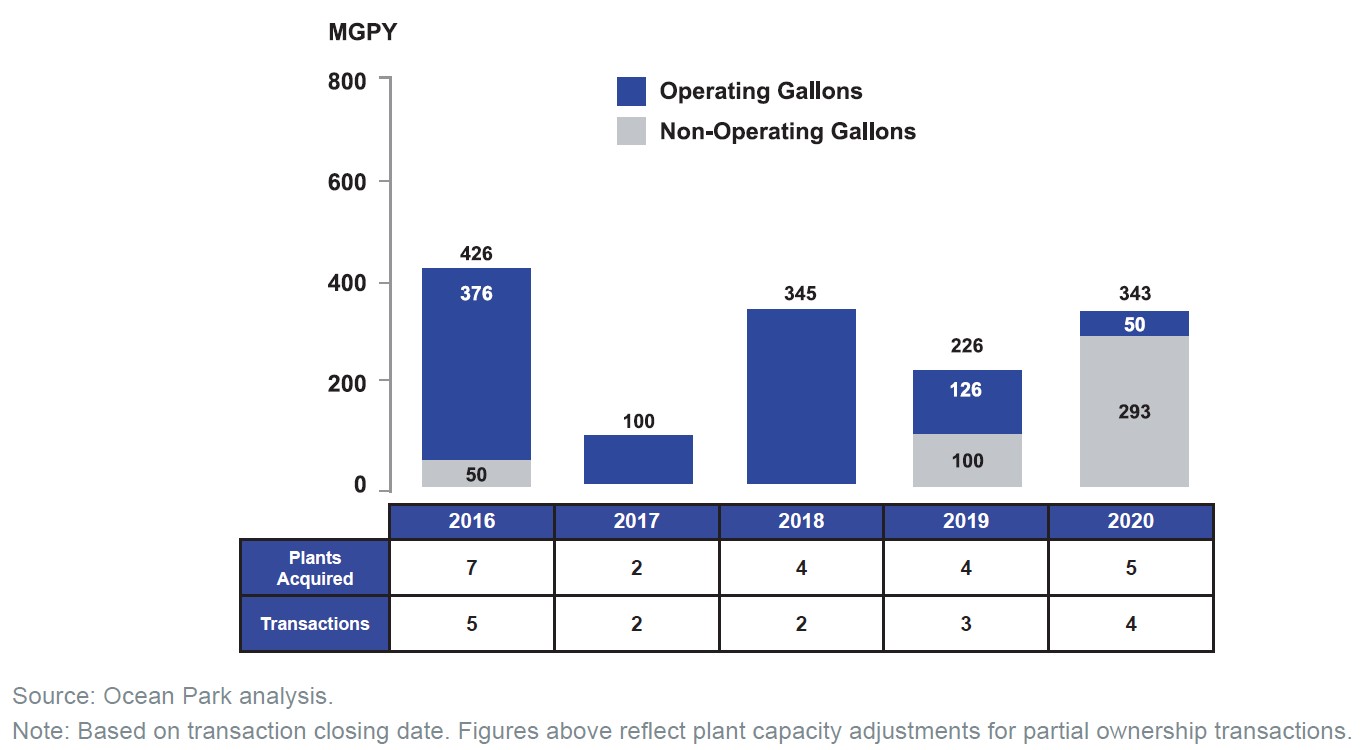

ETHANOL M&A

In 2020, ethanol valuations remained distressed as the buyer’s market continued. Of the four transactions during the year, three were for non-operating plants, which included one in bankruptcy. No operating plants were sold outright. The one operating plant that sold involved a distressed seller facing a going concern and seeking an infusion of capital.

The four transactions encompassed five plants with 343 MGPY of plant capacity:

- Already an existing shareholder, Aurora Cooperative acquired the remaining 74 percent ownership stake in Pacific Ethanol’s two non-operating plants in Aurora, Nebraska. With this $53 million acquisition, Aurora Co-op added 145 MGPY of capacity, a grain elevator and integrated rail facilities. The sale trimmed Pacific Ethanol’s total ethanol capacity by nearly 25 percent and resulted from Pacific Ethanol’s restructuring effort.

- Husker Ag acquired a 53 percent ownership stake in Lincolnway’s operating ethanol plant in Nevada, Iowa. Husker Ag acquired a majority ownership and will provide management services to the 50 MGPY original nameplate ethanol plant.

- Greenfield Global acquired Corn Plus’ non-operating ethanol plant in Winnebago, Minnesota. Acquired through a bankruptcy, the 48 MGPY ethanol plant has been idled since September 2019. Terms of the transaction were undisclosed.

- Hereford Ethanol Partners acquired Green Plains’ non-operating ethanol plant in Hereford, Texas in a non-distressed sale. The Texas-based investment group acquired the 100 MGPY plant for $39 million plus working capital. The deal terms also included contingent consideration of up to $75 million over a ten-year period related to carbon capture and sequestration.

NORTH AMERICAN ETHANOL M&A, 2016-2020

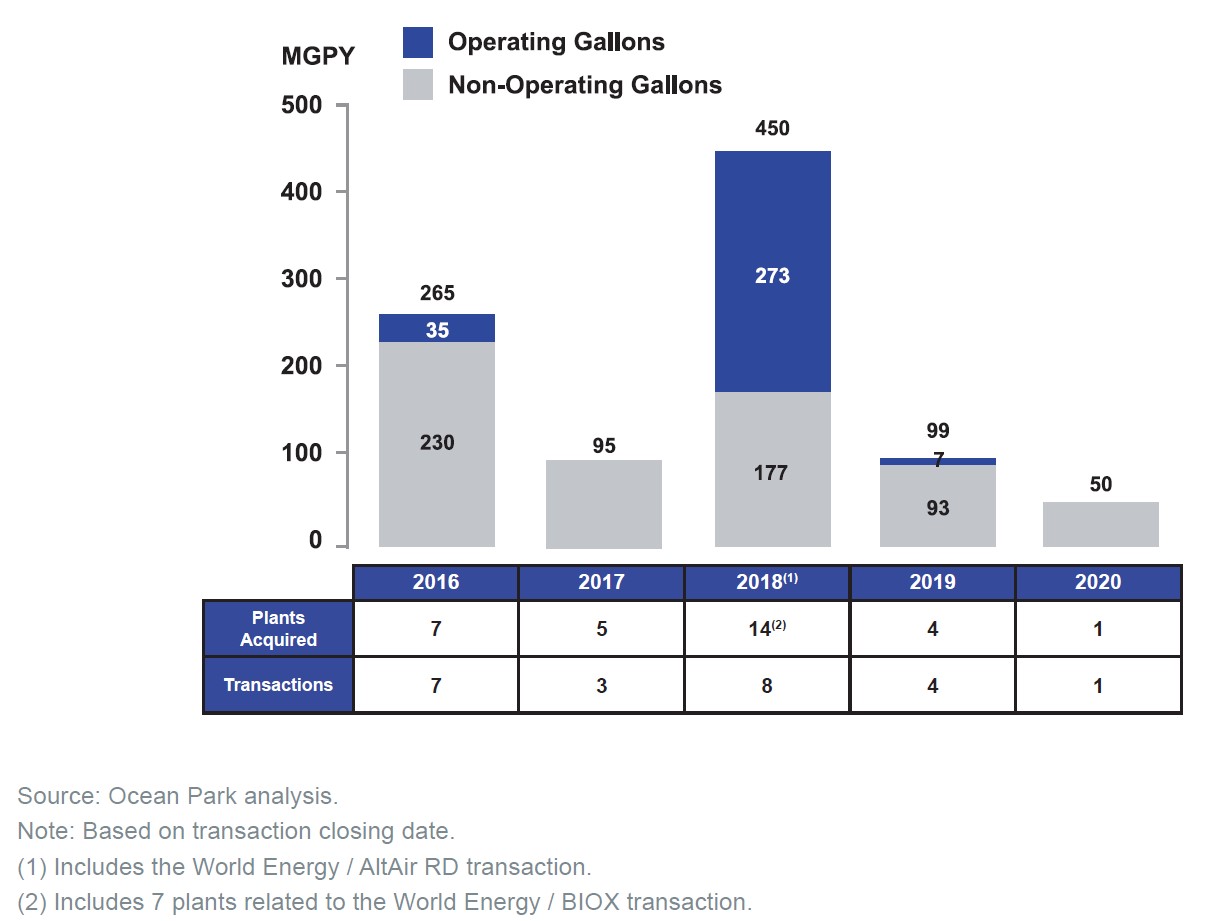

BIODIESEL M&A

2020 was by far the slowest year for biodiesel M&A in the last decade. No operating biodiesel plants changed ownership. The one biodiesel transaction in 2020 involved one non-operating plant with 50 MGPY of capacity, as follows:

- Marathon Petroleum acquired Flint Hills’ Duonix biodiesel plant in Beatrice, Nebraska. Marathon plans to use the former biodiesel facility to aggregate and pre-treat feedstocks for its RD plant in North Dakota. Flint Hills had originally purchased the non-operating plant in 2011.

NORTH AMERICAN BIODIESEL M&A, 2016-2020

ADVANCED BIOFUELS M&A

Advanced biofuels saw limited M&A activity during 2020. Ocean Park tracked two transactions involving one plant and technology:

- White Dog Labs, an alternative protein developer, purchased the Central Minnesota Renewables plant in Little Falls, MN for $9.2 million. Originally a 20 MGPY ethanol plant, it was retrofitted to produce butanol in 2016. White Dog Labs acquired the plant through a bankruptcy and will convert the plant to produce novel protein and feed additives for aquaculture facilities.

- National Carbon Technologies, a producer of high-value carbon products from renewable biomass, acquired Cool Planet’s biocarbon business. The Minnesota-based technology company owns the largest biocarbon production facility in the US and will use the biocarbon technology portfolio acquired to expand commercial production capabilities. Terms of the agreement were not disclosed.

NORTH AMERICAN BIOFUELS OUTLOOK FOR 2021

Regulatory: Pandemic relief and domestic support have eased near-term regulatory uncertainty. The biodiesel Blenders Tax Credit (BTC) is in place and the Renewable Fuel Standard (RFS) has not faced serious challenge. However, dozens of retroactive Small Refinery Exemptions (SREs) still await the outcome of litigation. In early 2021, the U.S. Supreme Court agreed to review the 10th Circuit Court ruling that severely limited the government’s powers to exempt small refineries from the RFS law, returning the biofuels industry to uncertainty.

The new Biden Administration has indicated support for California’s Low Carbon Fuel Standard (LCFS) as a possible replacement for the RFS. The RFS blending mandate for 2021 remains an unknown variable and was deferred to the new administration. The biofuels industry will look closely towards the Biden administration and new Congress to potentially set a new course for the RFS, tax and trade policy.

Ethanol: Sustained reductions in gasoline demand due to the ongoing pandemic are expected to continue to put pressure on ethanol producers and their margins. If these headwinds continue into 2021, distressed M&A activity might pick up as strategic buyers look for opportunistic acquisitions.

Biodiesel: Many producers collected windfalls in 2020 with the retroactive reinstatement of the BTC. However, the inverse relationship of Renewable Identification Number (RIN) values and BTC availability has normalized margins. Biodiesel production and demand held up in spite of the pandemic, indicating resilience in the heavy-duty diesel markets, which may continue into 2021. Feedstock values for biodiesel continued to strengthen from historic levels based on strong demand from the biofuels sector. Increased competition for feedstocks from new RD projects is expected to continue pressuring the biodiesel industry.

Renewable Diesel: Capital projects were underway to a significant extent with major oil companies and financial investors among the new entrants in 2020. Currently, 890 MGPY of capacity is under construction in the US. The wide margins in RD and growing costs of greenhouse gas compliance could continue motivating players to add low-carbon capacity through M&A, expansions and new construction. Unless the RFS mandates grow, RD will compete with biodiesel for feedstocks and compliance credits.

CONCLUSION

The year 2020 proved itself a transition period. Savvy ethanol producers quickly adjusted their product portfolio to capitalize on the demand for hand sanitizer and biodiesel companies shifting business plans to compete with RD. The biggest factor in biofuels over the next couple of years will be the rapid expansion in RD investments. If these announced expansions come to fruition, total biofuels capacity will far exceed mandates in the RFS, although aggressive carbon reduction goals in state policies (like the LCFS and others) could continue to grow market demand. If much of the new RD capacity bears out, then we may see plants bidding up feedstock prices, compressing margins and positioning the most efficient to survive. As nationwide shutdowns continue into 2021 pressuring fuel demand and margins, and absent additional pandemic relief funding, the M&A scene may be set for a busy year ahead.

ABOUT THE AUTHORS

BRUCE COMER is the founder and Managing Director of Ocean Park. He has decades of experience in business development, finance and operations both in the US and Asia. He has advised boards, funds, owners and lenders on growth strategies, capital structures, acquisitions, divestitures, restructurings and operational issues. His prior experience includes Platinum Equity, Asia Global Crossing, Merrill Lynch, Arthur D. Little, International Finance Corporation and Booz-Allen. He also previously served as the Chairman and Chief Executive Officer of Allegro Biodiesel, a publicly-traded company. Mr. Comer has published articles in industry journals, and has appeared at conferences and on CNBC to discuss the biodiesel industry. Mr. Comer received an AB, cum laude from Princeton University; an MA with Distinction in International Relations from Johns Hopkins University; and an MBA in Finance from The Wharton School.

FRANK KIM is as Director at Ocean Park and has over 15 years of investment banking and corporate development experience across the renewable energy, food, agribusiness, technology, and institutional capital industries. During his career at Ocean Park and previously with Credit Suisse and Deutsche Bank, Mr. Kim has executed over $2 billion in M&A transactions and in excess of $500 million in capital raises. Mr. Kim also has experience advising clients on multi-billion dollar engagements and multi-million dollar restructuring assignments. Previously, Mr. Kim was a Senior Manager at Silver Spring Networks, a smart energy grid platform provider, where he drove growth in sales operations worldwide. Mr. Kim received his Bachelor’s Degree in Economics from the University of California, Los Angeles and holds his Series 62, 63, and 79 licenses.

| BRUCE COMER Managing Director (310) 670-2721 bruce@oceanpk.com |

FRANK KIM Director (310) 670-7911 fkim@oceanpk.com |

Ocean Park is a leading boutique investment bank focused on the renewable fuels, energy, food, AgTech and agribusiness sectors. The Ocean Park team has significant operational and transaction experience, including advising on mergers and acquisitions, financings and restructurings. Since its founding in 2004, Ocean Park has successfully completed over 80 transactions and client engagements, including 30 biofuels transactions. Its professionals are based in Los Angeles, Houston and Omaha.

This material is solely for informational purposes. The information in this document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security or to provide any investment advice.

Any securities are offered through Ocean Park Securities, LLC, a member of FINRA and SIPC. Ocean Park’s professionals are licensed registered representatives of Ocean Park Securities, LLC. For more information, please visit oceanpk.com or call (310) 670-2093.