North American Agronomy M&A: 2024 Review and Outlook

April 21, 2025 | By Ocean Park

In this inaugural review of Agronomy Mergers and Acquisitions (M&A) in North America, we have tracked deals that involve the distribution and production of fertilizers, chemicals, seeds and other key crop inputs. To be sure, the market is sometimes opaque, because so many deals involve small, privately-held companies. The sector rarely discloses valuation or deal terms and even deals that we have advised on are not always included in the deal tables since neither party disclosed the transaction. Despite these challenges, our goal is to track as many deals as possible to look for trends and factors in dealmaking that are driving companies to either acquire or sell businesses. We will survey disclosed investments made by the larger crop input companies actively investing in smaller firms.

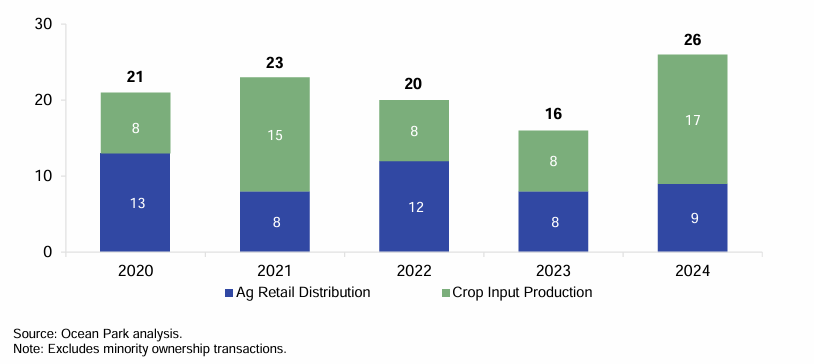

The ag retail distribution and crop input production sectors have faced mounting financial pressures over the past two years, driven by depressed commodity prices, tight margins, declining farm incomes, and rising operational costs. These challenges have led companies to evaluate consolidation opportunities, resulting in steady reported M&A activity. In 2024, deal activity reached 26 reported transactions, versus 16 deals reported in 2023 and the highest in the past five years.

North American Agronomy M&A Transactions, 2020-2024

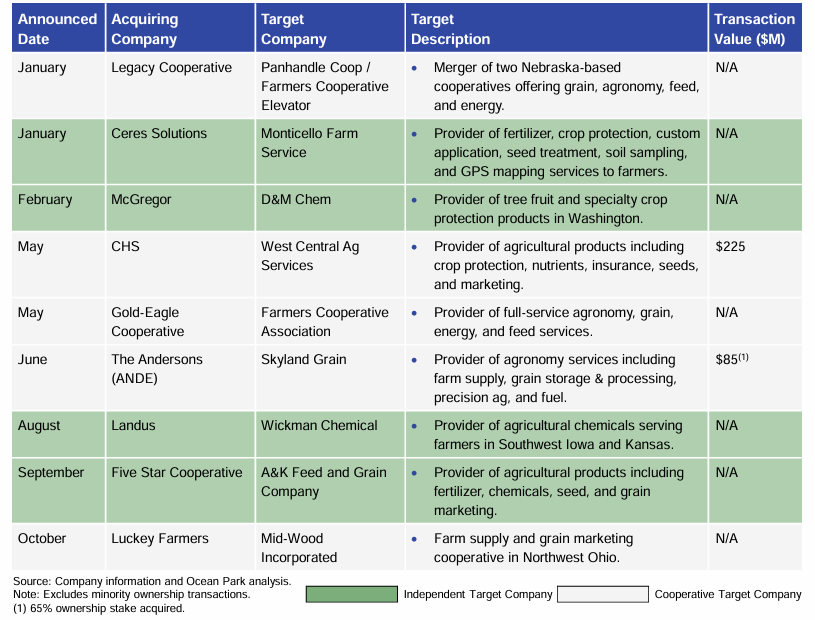

AG RETAIL DISTRIBUTION M&A

2024 was a busy year in ag retail with 9 M&A deals. A key theme was the increasing role of cooperatives across the deal landscape, notably:

- 8 of 9 transactions involved cooperatives as either the buyer or seller.

- 3 transactions were cooperatives picking up independent, private companies with ag retail operations.

- A publicly-traded agribusiness company (The Andersons) purchased majority control of a farmer-owned cooperative which was unusual from typical cooperative-to cooperative mergers.

- The largest farmer-owned cooperative (CHS) nearly lost its bid to acquire a regional co-op to a private company (The Arthur Companies). The structure of the deal also stood out since CHS ultimately acquired West Central with a revised cash bid instead of a non-cash merger.

- Many transactions involved retaining existing management teams, preserving the operational expertise that is in short supply.

- Most of these farmer-owned cooperatives have business operations that span beyond agronomy, offering grain, energy and other related services.

North American ag retail companies have been consolidating for decades. CropLife America reports that retail outlets have declined by nearly 75% since 1984. Despite fewer outlets, sales have increased with the increased need for nutrients, crop protection and seeds. Consolidation at the farm level has driven consolidation of farm services including equipment and finance across rural America.

Farmers demand speed and cutting-edge technology, pushing ag retailers to keep pace. At the retailer level, keeping up with farmers requires tough choices including reinvesting in assets and filling the need for higher-skill level employees. Meanwhile, regulatory, legal, tax, accounting, and IT complexities have made it more difficult for smaller independent retailers to compete.

However, consolidation is not a panacea. In excess, it burdens networks with outdated assets, depletes customer service, or loses local relationships and knowledge.

Independent ag retailers that focus primarily on distributing agronomy products and services more acutely face agronomy-specific market dynamics. After a few years of rising prices and profits during and immediately following the pandemic, market conditions have steadied with increased gross margin pressure and inflation pushing up operating expenses, such as labor and insurance. Smaller, independent ag retailers also might face the lack of a succession plan, difficulty in finding labor and uncertainty about technology investments. On the flipside, buyers of ag retailers are typically seeking geographic expansion, operational consolidation, broadened product portfolios, expansion into niche markets, local talent and customer relationships.

2024 North American Ag Retail Distribution M&A Transactions

Transaction Details:

- Panhandle Cooperative and Farmers Cooperative Elevator (FCE) merged to form Legacy Cooperative. Two Nebraska-based cooperatives, Panhandle and FCE, merged to form Legacy Cooperative. The combined entity will operate nine agronomy locations with eight in Nebraska and one in Wyoming, serving farmers across Nebraska, Wyoming, South Dakota, and Colorado.

- Ceres Solutions acquired Monticello Farm Service. Indiana-based cooperative Ceres Solutions deepened its local footprint with the acquisition of independent ag retailer Monticello Farm Service who offers agronomy services at two Indiana locations. The deal occurred while Ceres was finalizing its merger with Co-Alliance that formed Keystone Cooperative, a combined entity operating 89 agronomy locations serving farmers in Indiana, Ohio, Michigan and Illinois, with over $3B in annual sales.

- The McGregor Company acquired D&M Chem. McGregor, the largest family-owned independent ag retailer in the Pacific Northwest, expanded its footprint with the acquisition of D&M Chem, an independent ag retailer who specializes in permanent tree fruit and specialty crops across central Washington. The deal strengthens McGregor’s irrigated footprint and adds D&M Chem’s patented products to its portfolio.

- CHS acquired West Central Ag Services for $225M. CHS, the nation’s largest farmer-owned cooperative, expanded its footprint by acquiring West Central Ag Services, a cooperative based in Ulen, Minnesota that provides grain and agronomy services to more than 3,000 members. The deal includes 14 locations in west central Minnesota. The acquired business will operate as CHS West Central.

- Gold-Eagle Cooperative and Farmers Cooperative Association (FCA) Merged. Two Iowa-based cooperatives, Gold-Eagle and FCA merged in July. The merger combines FCA’s assets with Gold-Eagle’s operations in agronomy, grain, energy, feed, and a partnership with the CORN, LP ethanol plant in north-central Iowa. The combined entity, operating under Gold-Eagle, has over 200 employees across 30 locations in Iowa and Minnesota after integrating FCA’s two locations and 30

employees. - The Andersons (ANDE) acquired a 65% ownership stake in Skyland Grain for $85M. ANDE, a publicly-traded global diversified agribusiness with revenues of more than $10B headquartered in Maumee, Ohio, acquired a majority stake in Skyland Grain, a farmer-owned cooperative serving more than 7,000 members headquartered in Ulysses, Kansas. Skyland Grain operates 72 locations with over 400 employees across a full-service agronomy division and has more than 50 grain storage and handling facilities in Kansas, Oklahoma, Colorado, and Texas. Skyland Grain also holds a majority interest in Heartland Soil Services, a precision agronomy company. The acquisition strengthens ANDE’s Central US presence and approximately doubles the size of its ag retail business.

- Landus acquired Wickman Chemical. Landus, Iowa’s largest cooperative with revenues of over $2B and operations in agronomy, grain, and soybean processing across more than 60 locations, expanded its chemical portfolio with the acquisition of Wickman Chemical, an independent supplier with two locations in Iowa and Kansas. Wickman provides both branded and generic products across a portfolio of herbicides, adjuvants, fungicides, and insecticides.

- Five Star Cooperative bought A&K Feed and Grain Company. New Hampton, Iowa-based Five Star acquired A&K Feed & Grain, an independent agricultural retailer in Iowa. The acquisition strengthens Five Star’s presence in North Iowa and Southern Minnesota, adding A&K’s agronomy and grain assets from its sole location in Lime Springs to Five Star’s existing 19 locations.

- Luckey Farmers bought Mid-Wood Incorporated. Luckey Farmers bought Mid-Wood Incorporated. Luckey Farmers, a farm supply and grain marketing cooperative, merged with Mid-Wood in a regional consolidation that adds Mid-Wood’s eight locations to Luckey’s 11 across northwest Ohio and southeast Michigan. The merger will combine the agronomy, grain, energy, and feed divisions of both cooperatives.

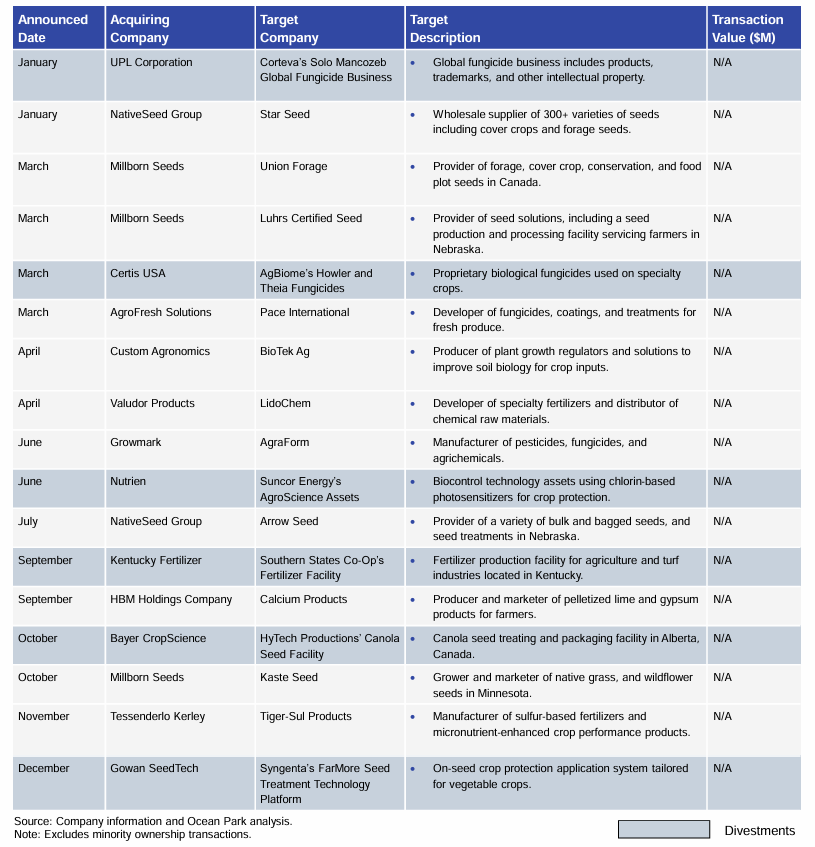

CROP INPUT PRODUCTION M&A

Crop input production M&A also had an active year in 2024 with 17 transactions. Companies acquired assets to integrate vertically and expand into the promising biologicals market. Notably, 6 of the 17 deals were divestments of non-core assets by larger players: AgBiome, Corteva, HyTech Productions, Southern States Co-op, Suncor Energy and Syngenta. There were also numerous transactions in the seed sector, which are highlighted in the Seed Spotlight.

2024 North American Crop Input Production M&A Transactions

SPOTLIGHT: 2024 Seed Sector Transactions

Millborn Seeds and The NativeSeed Group were busy consolidating the seed sector.

- The NativeSeed Group acquired Star Seed. NativeSeed, a portfolio company of Heartwood Partners, a Connecticut-based private equity firm and provider of seed products, acquired Kansas-based Star Seed. The acquisition adds Star Seed’s farm and conservation seeds to NativeSeed’s portfolio of 12 seed brands across 16 locations in 12 states.

- Millborn Seeds acquired Union Forage. Millborn Seeds, a provider of forage, cover crop, conservation and food plots seeds, acquired Alberta-based Union Forage. Millborn will integrate Union Forage’s seed products with its existing offerings, operating under Millborn’s Renovo Seed. Millborn operates two seed brands across six locations in South Dakota, Nebraska, Minnesota and Canada, selling 150M+ pounds of seed annually.

- Millborn Seed acquired Luhrs Certified Seed. Millborn Seeds made a second purchase in 2024, acquiring Nebraska-based Luhrs Certified Seed. Luhrs’ seed processing facility and seed solutions enhance Millborn’s offerings and distribution network in the Western Plains.

- The NativeSeed Group acquired Arrow Seed. NativeSeed made a second purchase in 2024, acquiring Arrow Seed, a Nebraska-based producer and supplier of various seeds. This acquisition further expands NativeSeed’s presence in the Midwest and enhances its product offerings with more warm-season seed varieties. The purchase marks NativeSeed’s second acquisition since Heartwood Partners bought NativeSeed in April 2022.

- Millborn Seeds acquired Kaste Seed. Millborn Seeds made a third purchase in 2024, acquiring Minnesota-based Kaste Seed, which specializes in native grass and wildflower seeds. The acquisition strengthens Millborn’s seed supply chain and brings its offerings to over 1,200 seed varieties. The purchase complements Millborn’s recent expansion into Canada by adding another nearby location. Kaste Seed will operate under the Millborn name.

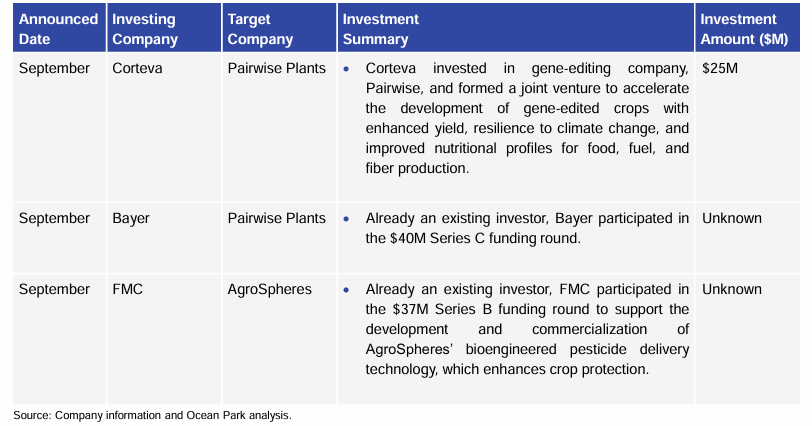

CROP INPUT INVESTMENTS BY THE MAJOR PUBLICLY-TRADED COMPANIES

The leading publicly-traded crop input companies did not make major acquisitions in 2024. However, they did provide capital to new technology companies. Corteva and Bayer both participated in the $40 million Series C funding round for Pairwise Plants, a gene-editing crop company utilizing CRISPR technology in food and agriculture. Corteva led the round with $25M. FMC invested in AgroSpheres’ $37 million Series B round to support its bioengineered pesticide delivery technology. These investments highlight how the major crop protection companies are leveraging venture investing to supplement their own R&D.

2024 North American Crop Input Public Company Investment Deals

2025 AGRONOMY OUTLOOK

In 2025, the agronomy market could be increasingly impacted for ag retailers by “see-and-spray” systems and biologicals, a threat to sales volumes of crop protection and crop nutrient products. Ag retailer profits are now under pressure again after expanding thanks to price surges in 2021 and 2022. Additionally, rising labor costs, workforce shortages, and patent expirations could present further challenges to ag retailers’ margins, forcing them to seek other avenues of profitability and expansion, whether organically or inorganically through M&A. The seed and biological segments are also likely to continue consolidating as smaller companies struggle to compete and survive independently. Financial pressures, labor challenges and uncertainty in technology investments could spur additional M&A across the sector in 2025.

These agronomy-specific factors will play out in the bigger picture of uncertainty in the economic and political environment that has emerged in early 2025. Trump Administration tariffs could destroy export markets and boost prices for fertilizers and crop protection products. This kind of volatility and uncertainty has typically dampened farmer spending and ag lending. One thing is certain in 2025, the end of the year is unlikely to look like the beginning as economic and policy norms disappear and something different will take their place.

Farrell Growth Group is a leading retail agronomy consulting firm with over 25 years of experience. FGG’s members represent over $5 billion in combined agronomy revenue and serve growers in 38 states as well as Canada. The firm has a strong track record in ag retail M&A, having worked on over 45 transactions. www.farrellgrowth.com

Ocean Park is a leading boutique investment bank focused on industry segments across the agricultural supply chain including the ag inputs, renewable fuels and chemicals, energy, food, and AgTech sectors. The Ocean Park team has significant operational and transaction experience, including advising on mergers and acquisitions, financings and restructurings. Since its founding in 2004, Ocean Park has successfully completed over 80 transactions and client engagements, including over 38 biofuels transactions. Its office is in Minneapolis, MN. oceanpk.com

This material is solely for informational purposes. The information in this document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security or to provide any investment advice. Any securities are offered through Ocean Park Securities, LLC, a member of FINRA and SIPC. Ocean Park’s professionals are licensed registered representatives of Ocean Park Securities, LLC. For more information, please visit oceanpk.com or call (310) 670-2093.