North American Biofuels M&A: 2024 Review and Outlook

Boosted by Exports, Ethanol M&A Stars in Tangled Biofuels Market

February 18, 2025 | By Ocean Park, As published in Biofuels Digest, January 2025

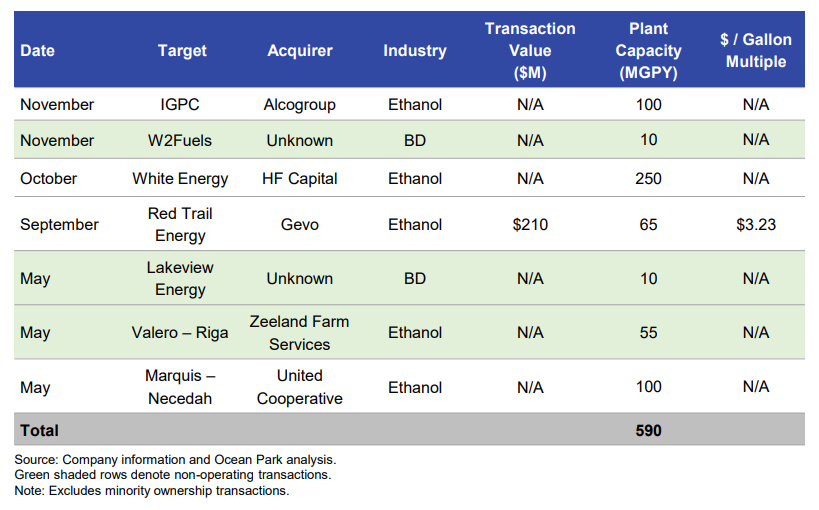

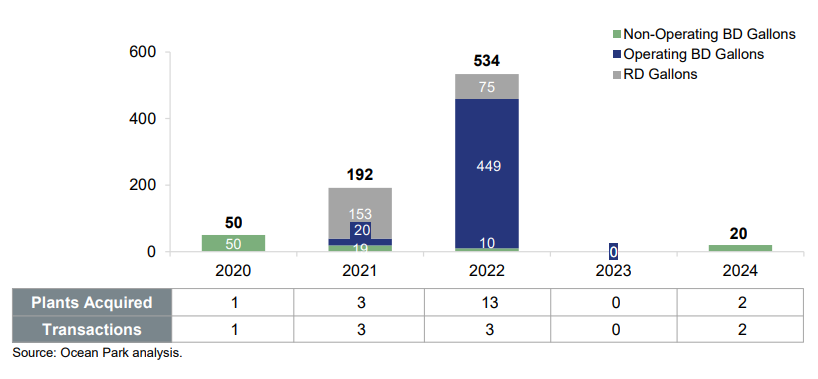

In a biofuels sector grappling with policy uncertainty and a new federal administration, there were promising capital investments and above average ethanol M&A volume, driven by export growth and profitable carbon capture and sequestration (CCS). The home run: Gevo’s landmark $210M purchase of Red Trail Energy. Overall, five operating ethanol plants and one non-operating plant totaling 570 million gallons per year (MGPY) of capacity changed hands in five deals. M&A activity in biomass-based diesel (BBD) was minimal with two non-operating biodiesel (BD) plants auctioned for a total of 20 MGPY.

Policy uncertainty, particularly around the Inflation Reduction Act (IRA), is hindering M&A activity. Sellers expect benefits from future policies while buyers are cautious without qualifying projects generating cash flow. It’s hard to feel confident when politicians and regulators are certain to keep changing the rules, but the floor is solid enough that investors have poured billions into carbon capture initiatives, refinery conversions for Sustainable Aviation Fuel (SAF) and securing feedstock. It’s important to keep an eye on Renewable Diesel (RD) and BD producers’ declining or negative margins due to oversupply and minimal increases in compliance volumes under the Renewable Fuel Standard (RFS).

2024 North American Biofuels M&A

ETHANOL M&A

NORTH AMERICAN ETHANOL M&A, 2020-2024

The story of 2024: ethanol M&A. Five operating and one non-operating plant changed hands. The five transactions involved six plants with a healthy 570 MGPY of combined capacity:

- Gevo acquired Red Trail Energy’s assets. Gevo acquired the 65 MGPY ethanol production plant and CCS assets of Red Trail Energy for $210 million. This deal sets a new high-water mark in ethanol M&A at a valuation of $3.23 / gallon due to the lucrative 45Q/45Z tax credits from Red Trail’s already operational CCS assets. Additionally, Red Trail became the first to generate CO2 Removal Certificates in the Voluntary Carbon Market. The transaction marks the first ethanol plant sale with active CCS operations, thus policy certainty for 10+ years. The North Dakota facility is permitted to sequester 180,000 MT of CO2 annually with significant room for expansion. The acquisition adds a second ethanol plant to Gevo’s fleet.

- Valero sold its idled ethanol plant to Zeeland Farm Services (ZFS). Zeeland Farm Services purchased Valero’s 55 MGPY ethanol plant in Riga Township, Michigan. This is ZFS’s third plant and increased its total capacity to 227 MGPY.

- United Cooperative acquired Marquis’ Wisconsin ethanol plant. United Cooperative entered the ethanol space with its acquisition of Marquis’ 100 MGPY operating ethanol facility in Necedah, Wisconsin.

- White Energy acquired by the Haslam Family Office, HF Capital. The Haslam family made its first direct ownership investment in ethanol by purchasing two operating plants in Plainview and Hereford, Texas from White Energy with 250 MGPY of total capacity. The Plainview plant has begun developing a CCS project. In September, HF Capital committed substantial capital to private equity firm ARA’s new decarbonization fund aimed at reducing carbon emissions from energy assets.

- Alcogroup acquired IGPC’s ethanol plant in Aylmer, Ontario. Alcogroup purchased Canada’s second largest plant from IGPC, adding 100 MGPY to its fleet. The acquisition marks Alcogroup’s first North American plant. Alcogroup already had 263 MGPY of ethanol capacity from its Belgium and Netherlands facilities.

This analysis does not include a minority ownership transaction in which Growmark purchased a stake in Big River Resources. Big River is currently the 7th largest ethanol producer with four plants and 430 MGPY of capacity. Financial terms were not disclosed.

If there was more ethanol M&A activity than expected, it’s because robust exports and CCS capabilities overshadowed large capital investments in decarbonization, plant expansions, and high-protein installations that may have diverted funds away from M&A. Additionally, valuation gaps fueled by uncertainty around IRA credits, have created friction, as buyers hesitate to pay for speculative decarbonization value for plants without significant policy certainty. But in the end, Tier 1 plants with direct-inject CCS capabilities, like Red Trail, should continue to command premium valuations. Additionally, record ethanol exports, projected at 1.9B gallons, and rising interest in SAF opportunities add to the sector’s M&A buy-side demand, despite challenges from inconsistent EBITDA performance and macro supply-demand dynamics.

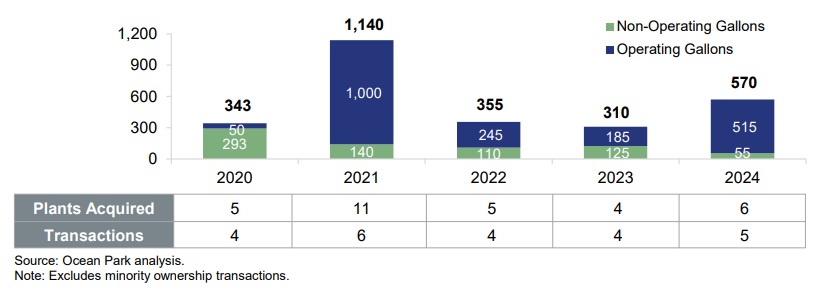

BIODIESEL & RENEWABLE DIESEL M&A

NORTH AMERICAN BIODIESEL & RENEWABLE DIESEL M&A, 2020-2024

There were two transactions in 2024 involving two plants and 20 MGPY of capacity.

- Lakeview Energy’s 10 MGPY Moberly, Missouri biodiesel plant sold in an auction. Lakeview Energy had purchased the plant from Producer’s Choice Soy Energy back in 2015.

- W2Fuels’ 10 MGPY biodiesel plant sold in an auction. Maas Companies, who facilitated a similar auction sale back in 2011, sold the Iowa plant for a second time this year. The plant had been idled since June 2023.

Unlike ethanol, the biodiesel sector is facing significant distress, which has dampened M&A activity. The number of independent biodiesel plants has declined steadily since 2020, leaving only 10–15 remaining in operation. Integrated producers now control about 70% of production, further limiting the pool of assets available for consolidation. Low RIN and Low Carbon Fuel Standard (LCFS) prices, driven by oversupply, have squeezed margins, leading to bankruptcies, plant idling, and even scrapped facilities. Not surprisingly, buyers have little interest in buying up unprofitable plants. Recent auctions and sales for distressed assets failed to drum up significant interest.

Renewable diesel is also struggling with oversupply and margin pressures. RD now accounts for approximately 65% of biomass-based diesel production in the U.S., driven by integrated oil companies focused on meeting compliance obligations. In 2024, ~1.5 BGPY of new capacity came online. This surge in production has flooded the market with advanced biofuels RINs and LCFS credits, pushing margins into thin or negative territory. Integrated RD producers remain focused on securing feedstock supply rather than acquiring additional production capacity. Given their dominance and strategic priorities, there is little appetite for M&A.

SAF / Advanced Biofuels M&A and Announcements

There was one notable transaction in 2024 involving one plant with 11 MGPY of capacity.

- The Assets of Fulcrum Sierra Biofuels, Fulcrum BioEnergy were sold in an auction. Financial terms for the idled 11 MGPY RD / SAF plant near Reno, NV were not disclosed.

SAF has generated significant attention, but the nascent market remains very small, with only 30-40 MGPY of SAF produced in the U.S. in 2024. Despite this, there has been a surge in investments from oil refiners and new players aiming to enter the space.

Notable announcements include:

- LanzaJet opened the world’s first ethanol-to-SAF facility in Georgia.

- Diamond Green completed its SAF project, which allows the company to upgrade up to 50% of its 470 MGPY capacity to SAF.

- Montana Renewables has started small SAF shipments and plans to add 150 MGPY by 2026, backed by a $1.4B DOE loan guarantee.

- Montana Renewables has started small SAF shipments and plans to add 150 MGPY by 2026, backed by a $1.4B DOE loan guarantee.

- Phillips 66 began SAF production in Q3 but paused in Q4.

- Gevo secured a $1.5B DOE loan for its South Dakota SAF plant.

- Twelve raised $645M to develop SAF using proprietary technology.

- Southwest Airlines invested in SAFFiRE Renewables, which will use LanzaJet’s technology to convert ethanol to SAF.

NORTH AMERICAN BIOFUELS OUTLOOK FOR 2025

Regulatory: The outcome of the recent election has introduced significant uncertainty around the future of key provisions in the IRA, with potential legislative changes, especially following the Republican Congressional sweep. Republican Senator John Thune’s election as Senate Majority Leader and former congressman Lee Zeldin’s appointment to lead the EPA suggest that agriculture and renewable fuels could have stronger support in the upcoming administration. The new leadership will likely impact decisions on the EPA’s Renewable Volume Obligations (RVOs), particularly for 2026 and 2027, after underwhelming targets set through 2025 have already hurt RIN values. Former North Dakota Governor Doug Burgum’s role as chair of the proposed National Energy Council, a proponent of renewable fuels and CCS, could also shape future favorable policies in those areas.

Amid these shifts, industry stakeholders are closely watching proposed rulemaking for IRA provisions, including Section 45Z which incentivizes biofuel producers to lower their Carbon Intensity scores. However, concerns remain that some provisions could be heavily limited. In California, the California Air Resources Board (CARB) has adopted updates to the LCFS, raising carbon intensity reduction targets. CARB has also imposed stricter regulations on feedstocks, limiting fuel made from soybean, canola, and sunflower oil to 20% of a company’s annual production. These updates, combined with the fact that California consumes 80% of renewable diesel, will be closely watched as new capacity comes online.

Ethanol: The policy outlook under the new administration is expected to be less supportive of ethanol, with refinery waivers re-entering the picture, creating additional supply and demand pressures. The potential impact of tariffs on ethanol trade further complicates the supply-demand dynamic, although the possible revisit of E15 could offer some offsetting support. Additionally, the future of the 45Z Clean Fuel Production Credit may be less favorable for ethanol producers, especially if qualification standards, such as climate-smart agriculture and data collection requirements, are more stringent. The slower-than-anticipated development of CCS projects, coupled with the potential lack of a robust 45Z credit, could further challenge project viability. M&A activity could become a more prominent story. New players are actively seeking asset acquisitions, and if margins remain under pressure, independent producers may feel compelled to sell, consolidating further under well-capitalized owners.

BBD: As production volumes continue to increase, the supply / demand imbalance appears to be headed further out of balance. If RIN and LCFS credit prices do not rebound, we expect continued distress in the sector which could spur opportunistic M&A or further plant shutdowns.

CONCLUSION

There’s no doubt the biofuels sector gained ground in 2024, with notable capital investments and active M&A, particularly in ethanol. The Gevo-Red Trail Energy acquisition set a high mark in ethanol transactions, driven by CCS potential and favorable tax credits. However, uncertainty surrounding policies like the IRA, particularly with changes in the executive branch and Congress, has spooked the market, and potential buyers, limiting further M&A activity. The outlook for carbon capture projects remains clouded by slow development and policy unpredictability, particularly with the potential restructuring of key tax credits. Additionally, the biodiesel and renewable diesel sectors are hampered by oversupply and margin pressures, dampening M&A interest. Overall, the biofuels industry is at a crossroads, with regulatory uncertainties, economic pressures, and strategic investments shaping the future of M&A and sector growth. The policy environment and market conditions could force biofuels producers to adapt or consolidate to stay competitive in an increasingly complex landscape.

Ocean Park is a leading boutique investment bank focused on industry segments across the agricultural supply chain including the ag inputs, renewable fuels and chemicals, energy, food, and AgTech sectors. The Ocean Park team has significant operational and transaction experience, including advising on mergers and acquisitions, financings and restructurings. Since its founding in 2004, Ocean Park has successfully completed over 80 transactions and client engagements, including over 38 biofuels transactions. Its office is in Minneapolis, MN.

This material is solely for informational purposes. The information in this document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security or to provide any investment advice. Any securities are offered through Ocean Park Securities, LLC, a member of FINRA and SIPC. Ocean Park’s professionals are licensed registered representatives of Ocean Park Securities, LLC. For more information, please visit oceanpk.com or call (310) 670-2093.