Limited Biofuels M&A Activity: 2019 Review

Slowdown in North American biofuels Mergers and Acquisitions as thin margins and policy uncertainty hung over industry

February 2020 | By Bruce Comer

Biofuels Merger and Acquisition (M&A) activity in North America was subdued in 2019. Only four operating biodiesel, ethanol and advanced biofuels plants were sold during the year. These four acquired plants were relatively small with a combined capacity of only 133 Million Gallons Per Year. No large-scale, operating biofuels plants changed hands – which is rare for the biofuels M&A market.

The rest of Biofuels M&A activity in 2019 generally involved sub-scale, idled or non-operating plants, along with technology assets. Ocean Park tracked four deals for non-operating ethanol and biodiesel plants that had a combined capacity of 193 MGPY. There were other salvage deals that were not included in the analysis. In advanced biofuels, two plants traded along with three deals for technology assets.

Several factors slowed biofuels M&A in 2019 – an oversupplied, low margin environment, policy uncertainty, limited capital availability and an absence of active buyers. Ocean Park tracked several broken sales processes.

Ethanol M&A

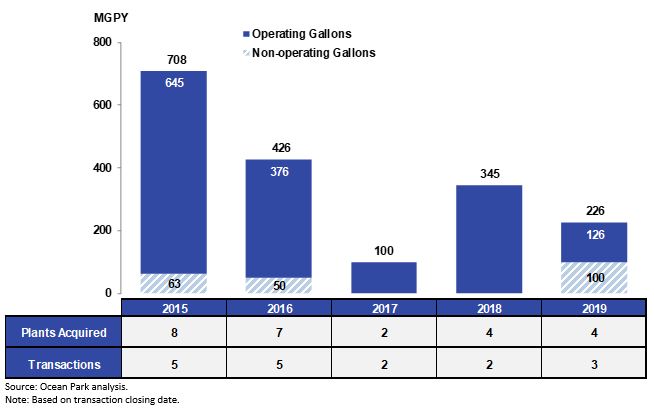

In 2019, ethanol transaction volume remained historically low and valuations declined. The total capacity that changed hands was the second lowest in five years. It included only two transactions with operating plants.

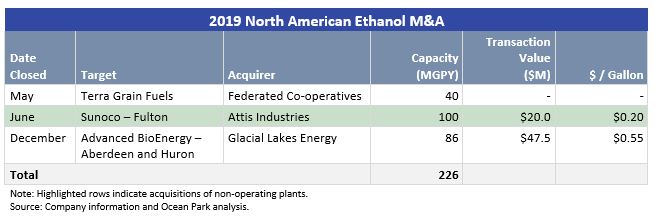

The three transactions encompassed four plants with 226 MGPY of production capacity, as follows:

- Federated Co-operatives acquired Terra Grain Fuels’ operating ethanol plant in Belle Plaine, Saskatchewan, Canada. Federated Co-operatives will continue to operate the 40 MGPY plant. Terms were not disclosed.

- Attis Industries acquired Sunoco’s non-operating ethanol plant in Fulton, New York. Sunoco divested its only ethanol plant in the US for $20M. As part of the transaction, Sunoco entered into a 10-year offtake agreement with Attis Industries.

- Glacial Lakes Energy acquired two operating ethanol plants in South Dakota from Advanced BioEnergy. With this $47.5M acquisition, Glacial Lakes now owns four plants in South Dakota.

NORTH AMERICAN ETHANOL M&A, 2015-2019

US ethanol producers were plagued by a glut of product and the lowest margins since 2008. According to Iowa State University’s Center for Agricultural and Rural Development, operating margins for US ethanol producers averaged just $0.08 per gallon in 2019.

Thin margins forced several ethanol plants to curtail or cease production. Some of the industry’s largest players idled their capacity. Some of the more notable idled or shutdown plants included:

- Valero’s plants in Bluffton, Indiana and Riga, Michigan, totalling 170 MGPY.

- POET’s 92 MGPY plant in Cloverdale, Indiana.

- Siouxland Energy Cooperative’s 90 MGPY plant in Sioux Center, Iowa.

- Plymouth Energy’s 50 MGPY plant in Merrill, Iowa.

- Three Rivers Energy’s 50 MGPY plant in Coshocton, Ohio.

- Corn Plus’ 40 MGPY plant in Winnebago, Minnesota.

Low margins prompted strategic buyers to delay or curtail M&A activity. This buyers’ market drove down valuations. Advanced BioEnergy’s sale to Glacial Lakes Energy for $48M, a valuation of $0.55 per gallon, underscored the pressure on valuations. The price was well below the five-year average of $0.72 per gallon.

Biodiesel M&A

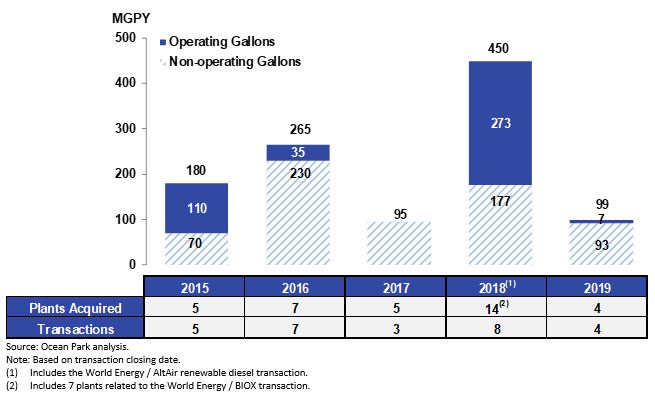

Following a banner M&A year for biodiesel in 2018, biodiesel M&A in 2019 was limited to idled, non-operating, or sub-scale plants. Both the number of plants and the cumulative production capacity that changed hands were near five-year lows. Of the four transactions during the year, three were for non-operating plants. The only other acquisition was for a sub-10 MGPY operating plant.

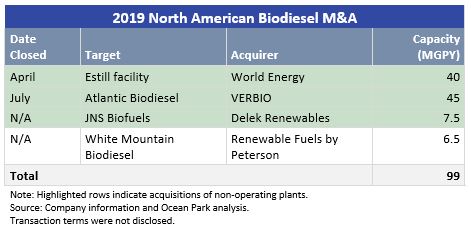

The four transactions encompassed four plants with 99 MGPY of capacity as follows:

- World Energy acquired an idled plant in Estill, South Carolina. World Energy acquired the non-operating 40 MGPY facility. Terms were not disclosed.

- VERBIO acquired a non-operating plant from Atlantic Biodiesel in Welland, Ontario, Canada. The Germany-based biofuels producer acquired Atlantic Biodiesel, the second-largest biodiesel plant in Canada at 45 MGPY. Terms were not disclosed.

- Delek acquired a non-operating plant from JNS Biofuels in New Albany, Mississippi. Delek added to its fleet by buying this 7.5 MGPY plant, Delek’s third biodiesel plant. Terms were not disclosed.

- Renewable Fuels by Peterson acquired one operating plant from White Mountain Biodiesel in Haverhill, New Hampshire. Renewable Fuels by Peterson purchased this 6.5 MGPY plant. Terms were not disclosed.

NORTH AMERICAN BIODIESEL M&A, 2015-2019

US biodiesel producers faced a challenging environment in 2019 – no collection of the 2018 BTC proceeds, no clarity for the BTC credit and the encroaching competition from renewable diesel.

Similarly to ethanol producers, several biodiesel companies cut production due to low margins. Some of the more notable companies idling or shutting down included the following:

- World Energy’s plants in Harrisburg, Pennsylvania; Natchez, Mississippi and Rome, Georgia, totalling 135 MGPY.

- Flint Hills’ 50 MGPY plant in Beatrice, Nebraska.

- Kolmar scaled back production by half at its 40 MGPY plant in New Haven, Connecticut.

- W2 Fuel’s plants in Crawfordsville, Iowa and Adrian, Michigan totalling 20 MGPY.

- Chesapeake Green Fuels’ 10 MGPY plant in Clayton, Delaware.

- Integrity Biofuels’ 5 MGPY plant in Morristown, Indiana.

This operating environment created doubt for the potential buyers of biodiesel plants.

Advanced Biofuels

Advanced biofuels saw limited M&A activity during 2019. Two plants traded in 2019. The three other deals involved technology or intellectual property. None of the deals, as follows, disclosed terms:

- Seaboard Energy purchased Synata Bio’s idled cellulosic ethanol plant in Hugoton, Kansas. Seaboard is evaluating the best potential opportunities and uses for the acquired assets, including modifications to produce renewable diesel. Synata Bio had originally purchased the non-operating plant out of bankruptcy from Abengoa in 2016.

- Brazil-based GranBio acquired the physical assets and intellectual property portfolio of American Process, based in Atlanta, Georgia. The acquisition includes American Process’ bio-refinery in Alpena, Michigan. GranBio intends to use the acquired assets’ intellectual property for conversion of biomass to renewable fuels, chemicals and nanocellulose.

- Genomatica acquired the assets of REG Life Sciences. Genomatica will continue to collaborate with ExxonMobil and Clariant to progress the advanced biofuels research program started at REG.

- New Energy Blue acquired exclusive rights to Inbicon’s bio-conversion technology throughout the US. New Energy Blue intends to employ the technology at its Spiritwood, North Dakota refinery, where it will convert wheat and barley straw and corn stover into cellulosic ethanol.

- Petron Scientech acquired cellulosic process technology assets from Dupont. The acquired assets included DuPont’s process technology to produce cellulosic ethanol from biomass.

North American Biofuels Outlook for 2020

Regulatory: After a rocky, nearly two-year period of uncertainty regarding the BTC, the biodiesel industry reached a significant milestone in late 2019 when the BTC was reinstated retroactively from its expiry in January 2018 through December 2022. This multi-year extension eases near-term regulatory concerns and could prompt more investment and M&A in biodiesel. Small Refinery Exemptions to the Renewable Fuel Standard, granted by the Environmental Protection Agency, remain an unknown variable that could continue to hurt demand.

Ethanol: High production volumes, trade dispute and policy changes limiting demand created major pressures for plant owners in 2019. If these headwinds continue into 2020, look for continued plant idling or distressed M&A activity. A few larger players might return to the M&A scene, lured by the prospect of attractive valuation levels for plant assets.

Biodiesel: Due to the reinstatement of the BTC, many producers will collect windfalls. In the near-term, many biodiesel operators could have the capital to restart, operate or acquire plants.

Renewable Diesel: Given the wide profit margins, the market expects more renewable diesel to come on-line over the next year or two. Currently, 882 MGPY of renewable diesel capacity is under construction in the US.

Advanced Biofuels: The advanced biofuels industry is waiting for a technological breakthrough. Several innovative companies, including Red Rock, Fulcrum BioEnergy, and LanzaTech are building plants that will utilize new feedstocks.

Given the limited M&A activity for operating plants in 2019, it will not take much in 2020 to top this past year in deal activity and value.

To download a PDF copy of the article: Click Here

Ocean Park is a leading boutique investment bank focused on the renewable fuels, energy, food, AgTech and agribusiness sectors. The Ocean Park team has significant operational and transaction experience, including advising on mergers and acquisitions, financings and restructurings. Since its founding in 2004, Ocean Park has successfully completed over 60 transactions and client engagements, including 30 biofuels transactions. Its professionals are based in Los Angeles, Houston and Omaha. For more information, please visit oceanpk.com or call (310) 670-2093.

Any securities are offered through Ocean Park Securities, LLC, a member of FINRA and SIPC. Ocean Park’s professionals are licensed registered representatives of Ocean Park Securities, LLC.