Biofuels International: 2015: A strong year for biofuels M&A

The North American biofuels industry saw more mergers and acquisitions in 2015 than during several previous years

January 2016 | By Bruce Comer

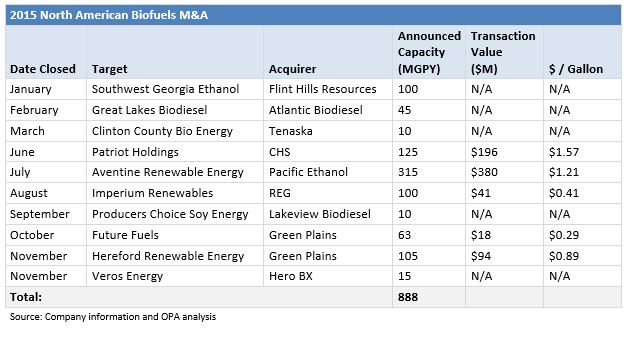

The North American biofuels industry witnessed a lot of M&A activity last year as consolidation continued in the ethanol and biodiesel subsectors. Ocean Park Advisors, a Los Angeles-based corporate finance advisory firm, tracked 10 M&A transactions worth an estimated $750 million to $850 million (€683-€774m) in value that involved 13 plants with 888MGPY of production capacity. In addition, there were four additional acquisitions of advanced biofuels companies. While values for specific plants vary widely, 2015 saw the highest, publicly-reported price paid per gallon of production for an ethanol plant ($1.57 for the Patriot Holdings plant). In biodiesel, the sale of the former Imperium Renewables plant in Grays Harbor, Washington, was the largest publicly-announced M&A acquisition of an operating biodiesel plant (100MGPY). The continued theme of consolidation of the past several years continued as serial acquirers (Green Plains, Flint Hills, and REG) and the Pacific Ethanol-Aventine merger accounted for over three quarters of the gallons transacted.

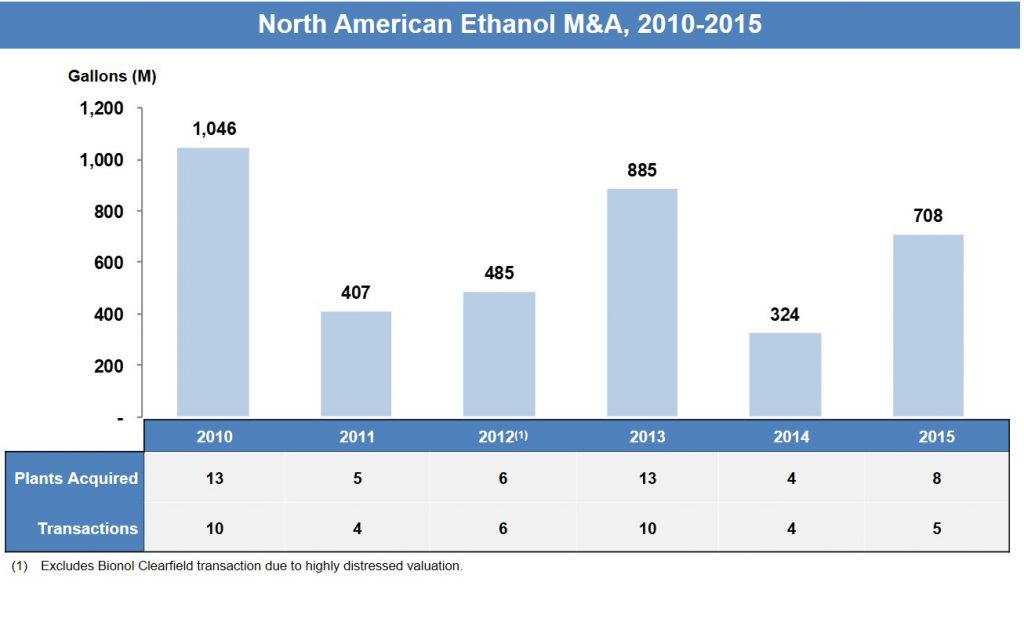

Ethanol M&A

Over the past five years, the ethanol sector has averaged about a half dozen acquisitions totalling to 600MGPY of production capacity per year. Many of these deals are single-plant sales to larger, integrated industry players. The four transactions in 2015 followed this trend at 708 MGPY of capacity across 8 plants in 5 transactions:

- Flint Hills acquired Southwest Georgia Ethanol – Flint Hills expanded its fleet by venturing into the Southeast to buy this plant from non-strategic sellers.

- CHS acquired Patriot Holdings – the major energy player, CHS, expanded its production with the acquisition of this 125MGPY operating plant.

- Pacific Ethanol merged with Aventine Renewable Energy – the publicly-traded Pacific Ethanol used its stock to acquire the Nebraska and Illinois plants from Aventine.

- Green Plains acquired Future Fuels – Green Plains picked up this non-operating plant located in Hopewell, Virginia.

- Green Plains acquired Hereford Renewable Energy – its fifth deal in the last five years, Green Plains expanded its reach into Texas.

Aside from the CHS transaction, these deals fit the model of the larger players expanding capacity through acquisition. Green Plains now operates 1.2BGPY, while Flint Hills reached 750MGPY of capacity by the end of 2015. The newly combined Pacific Ethanol now runs 515MGPY of capacity.

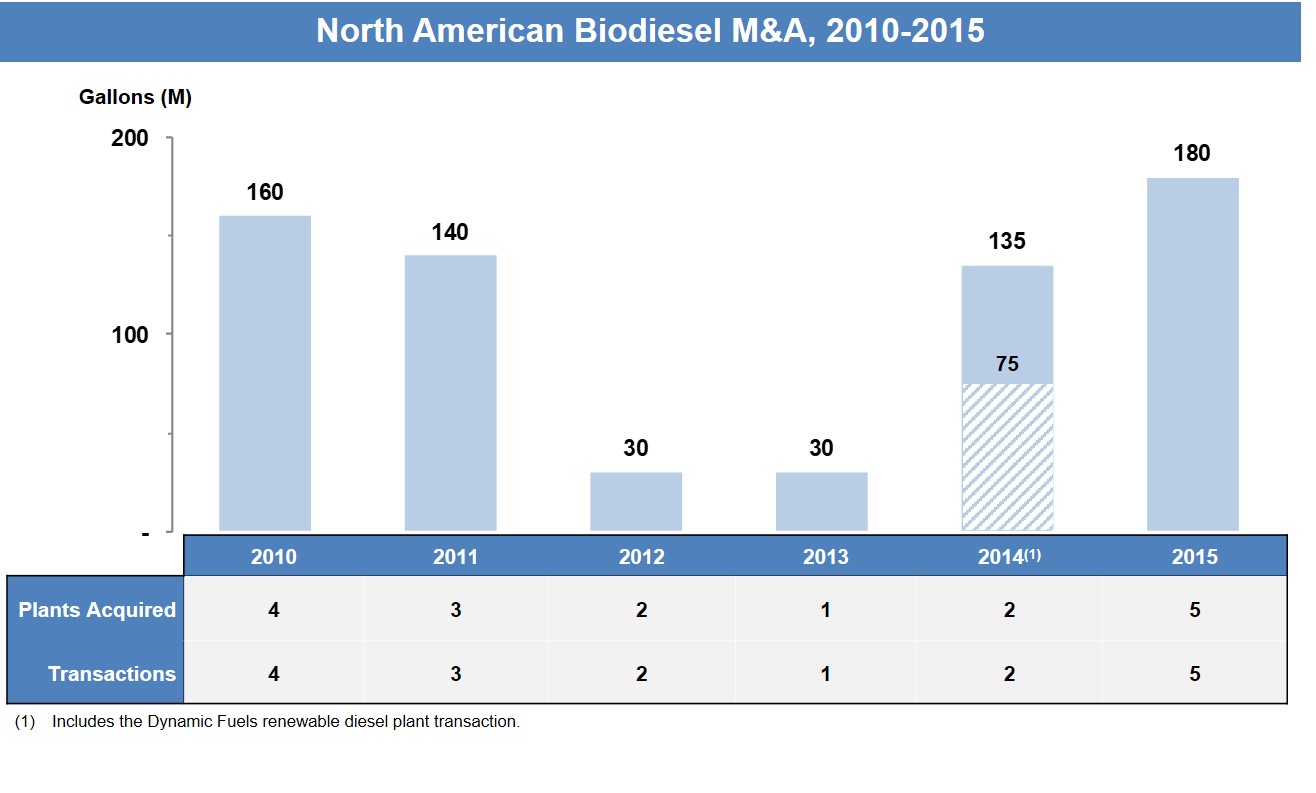

Biodiesel M&A

Biodiesel is much smaller than ethanol in terms of production capacity, so one would expect M&A to be smaller. The financial health of the sector has generally been weaker than ethanol, so there has been less impetus for M&A. Prior to 2015, Ocean Park had only tracked 12 publicly-announced M&A deals in the biodiesel sector. This figure excludes the numerous liquidations or distressed sales of plants that were unlikely to ever operate again. In this context, 2015 was a banner year for biodiesel M&A, with five deals for five plants with a combined 180MGPY of production capacity. Here is a quick look at this year’s deals:

- Atlantic Biodiesel acquires Great Lakes Biodiesel – Atlantic Biodiesel won the bankruptcy auction to own and restart operations of this Canadian plant.

- Tenaska acquires Clinton County Bio Energy – Tenaska ventured into owning production assets by buying this Iowa-based plant.

- REG acquires Imperium Renewables – REG expanded west by picking up the largest plant on the West Coast that is also strategically located at a marine terminal.

- Lakeview Biodiesel acquires Producers Choice – Lakeview acquired this non-operating plant in Missouri.

- HeroBX buys Veros Energy – The Lake Erie, Pennsylvania, operator added additional capacity located in Alabama.

As mentioned before, REG’s acquisition of the former Imperium Renewables plant was the largest announced deal in the sector. The consolidation theme continued in biodiesel as well. REG closed its 10th deal since 2010, accounting for 63% of the deals closed and 66% of the gallons acquired during this period.

Advanced Biofuels

Ocean Park tracked four M&A deals in advanced biofuels during 2015. Most of these transactions were part of a wind-down process. First, Renmatix acquired Mascoma’s demonstration plant located in Rome, New York, for an undisclosed amount. The demonstration plant will serve as the front-end processing of biomass that will supply Renmatix’s sugar production unit in Georgia. Second, Cargill acquired the fermentation technology assets of Boulder, Colorado-based OPX Biotechnologies. The acquisition deepened Cargill’s bio-based chemicals capabilities. Third, a joint venture formed by GranBio and Solvay acquired the intellectual property assets of Cobalt Technologies in a wind-down sale. Finally, several parties bought components of KiOR’s plant in Columbus, Mississippi.

Outlook for 2016

Ocean Park expects consolidation to continue in the ethanol industry. There are still 94 stand-alone plants that account for 5.3 billion gallons or 35% of domestic production. With dampened expectations for future margins, Ocean Park expects any remaining non-strategic players to explore exits. Furthermore, boards of stand-alone plants will continue to weigh the benefits and risks of remaining independent in an industry that continues to consolidate. Finally, financial distress at the corporate level of Abengoa could put their 400MGPY of US-based ethanol production capacity in play. For biodiesel, 2016 could be a bumper M&A year depending on Congressional action on the Blenders Tax Credit and/or Producers Tax Credit and the industry’s reaction to the increased Renewable Volume Obligation (RVO) issued by the US Environmental Protection Agency (EPA). At press time, these issues were still undecided. Advanced biofuels, such as cellulosic, faced stiff headwinds in 2015 as funding remained scarce and many business plans were disrupted by falling crude prices and EPA reductions in the RVO. Ocean Park expects more advanced biofuels companies to seek mergers or sales in 2016 if these difficult industry conditions persist.

To view the original article: Click Here